How to Calculate Customer Lifetime Value Accurately

- Chase McGowan

- Nov 8, 2025

- 12 min read

It's time to stop guessing how much you should be spending on ads.

Calculating customer lifetime value is the secret to knowing exactly what a new customer is worth to you over time. It’s the critical shift from trusting fuzzy, feel-good metrics fed to you by bloated agencies to making sharp, data-driven decisions that actually grow your business. As a specialized consultant, I focus on the latter.

Stop Guessing and Start Calculating CLV

Let's be real for a second. Far too many businesses treat their Google Ads budget like a slot machine. You put money in, pull the lever, and just hope for a win.

It's a common trap, often encouraged by big, over-priced agencies that love to show you impressive-looking reports filled with clicks and impressions. These "vanity metrics" look great on paper but tell you absolutely nothing about your bottom line. It's time to put an end to that.

Imagine knowing, with total confidence, the precise dollar value of a new customer. That’s the clarity that Customer Lifetime Value (CLV) gives you. This guide will cut through the agency hype and show you why CLV is the single most important metric for making smart Google Ads decisions.

Moving Beyond Single-Sale Thinking

If you're only focused on the profit from the very first sale, you're playing a short-sighted game and leaving a ton of money on the table. A customer who buys a $50 product today could easily end up spending $500 with you over the next couple of years.

When you ignore that long-term potential, you will always underestimate how much you can really afford to spend to acquire high-quality customers who stick around.

The shift from one-off sales to long-term value transforms your advertising. It’s the difference between guessing what a click is worth and knowing precisely how much you can pay to acquire a profitable customer for life.

As an independent consultant, my work is all about driving real profit, not just generating clicks. Bloated agencies often miss this, charging huge fees to report on metrics that have zero impact on your bank account. My approach is different. I give you the tools to understand core business drivers like CLV, turning every dollar you spend on ads into a calculated investment. This concept is fundamental and connects directly to other vital metrics, which is why I put together a guide on how to calculate return on ad spend here: https://www.cometogether.media/single-post/how-to-calculate-return-on-ad-spend-a-consultant-s-guide-to-real-profit.

The Real Advantage of Knowing Your CLV

Once you know how to calculate customer lifetime value, you gain a massive strategic advantage. You can stop being reactive to the market and start being proactive with your budget.

This knowledge empowers you to:

Set Realistic Budgets: You can confidently allocate funds because you know the long-term return you're aiming for.

Outbid Competitors: You can afford to bid on more competitive—and valuable—keywords when you understand the full payback horizon.

Identify Your Best Customers: You can finally pinpoint the traits of your most profitable customers and then go find more people just like them.

To get the most out of your ad spend, you need a solid grasp of foundational marketing principles, and CLV is right at the top of that list. For a broader look at how all the pieces fit together, I highly recommend checking out a comprehensive beginner's guide to digital marketing.

Gathering the Right Data Without an Army of Analysts

Big agencies love to make data collection sound like an impossibly complex beast. They paint a picture of teams of analysts and expensive software, all to justify their eye-watering monthly retainers.

I'm here to tell you that’s mostly hype. You don't need a massive budget or a degree in statistics to get the numbers that actually matter.

The truth is, you probably already have access to the handful of data points needed for a powerful CLV calculation. This isn't about getting lost in "big data"—it's about zeroing in on smart data that reflects the real-world health of your business. As a consultant who lives and breathes efficiency, my goal is to show you how to find these numbers quickly so we can start acting on them, without the agency overhead.

Finding Your Average Purchase Value

First up, we need your Average Purchase Value (APV). This is simply how much a customer spends, on average, in a single transaction. It’s a common mistake to overthink this one; the answer is almost always hiding in plain sight.

For E-commerce Stores: Platforms like Shopify and WooCommerce literally hand you this number. Just look for "average order value" in your analytics or sales reports.

For Service Businesses: Your payment processor (Stripe, Square) or accounting software (QuickBooks) has what you need. Divide your total revenue over a set period by the number of individual transactions in that same timeframe. Done.

Don't let an agency turn this into a week-long data science project. Finding your APV is a five-minute task, and it's the first step to grounding your CLV in what's actually happening in your bank account.

Calculating Purchase Frequency and Lifespan

Next, we need to figure out how often customers come back (Purchase Frequency) and how long they stick around (Customer Lifespan). Once again, the tools you use every day hold the answers.

Just pull a simple sales history report from your CRM or e-commerce platform.

To get your purchase frequency, divide the total number of orders by the number of unique customers over a specific period (like one year). For lifespan, a solid estimate based on your customer history is a fantastic starting point. If you notice most customers re-order for about two years before trailing off, use that.

This practical approach gives you a realistic baseline for CLV. You don't need predictive modeling to get started. You need actionable numbers that reflect what your business is doing right now.

This entire process is critical because it informs every single part of your advertising strategy, including how you track results. A rock-solid understanding of your customer journey is also central to more advanced strategies like attribution modeling. You can dig into a consultant's guide vs. agency hype to see how specialized knowledge makes a huge difference there, too.

The Simple CLV Formula for Smarter Ad Buys

Forget those overly complex, academic formulas some consultants love to trot out to justify their fees. The goal here isn't to build a perfect mathematical model that requires a PhD to understand. It's to find a number that's powerful enough to actually guide your Google Ads strategy. As a specialist, I care about actionable insights, not confusing spreadsheets.

We’re going to stick with the simple, historical CLV model. It's effective, easy to calculate, and gives you the clarity you need to start making smarter ad buys right away.

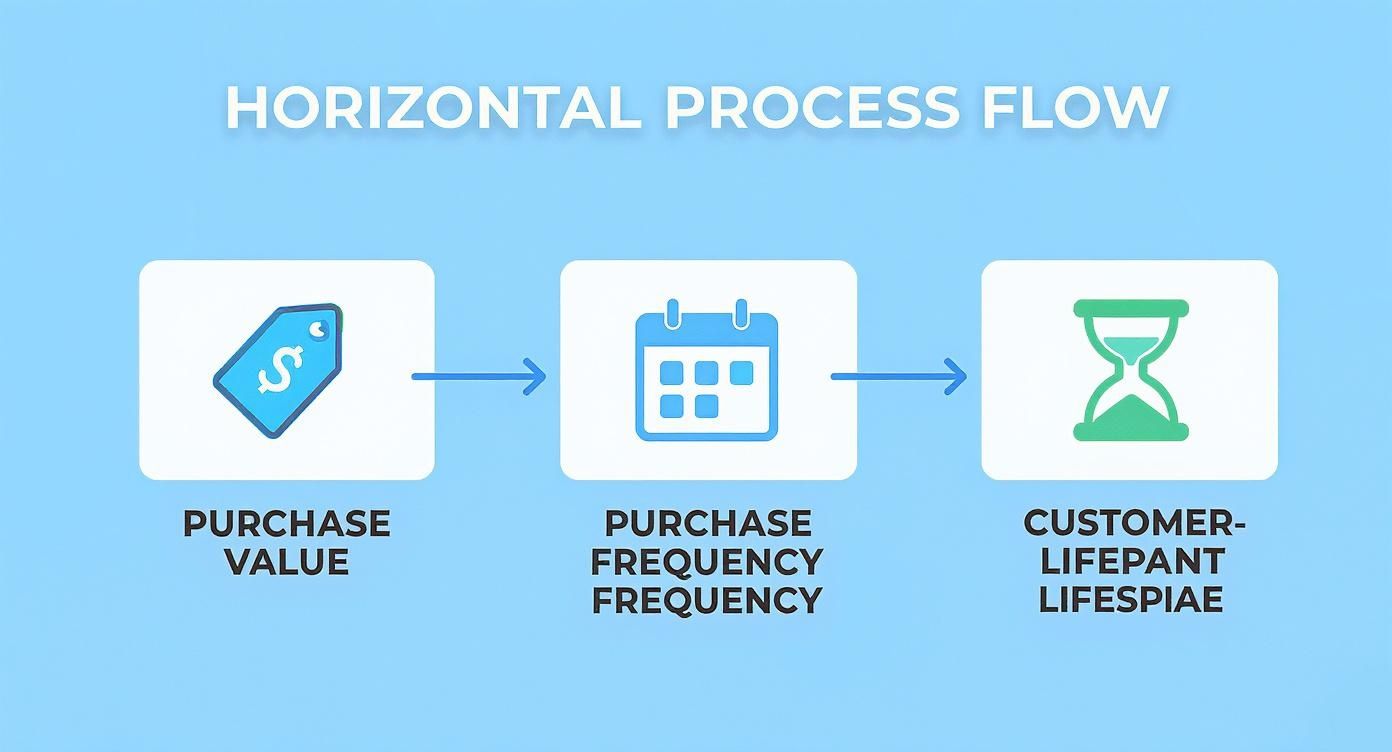

The formula is dead simple: Average Purchase Value × Purchase Frequency × Customer Lifespan.

This simple flow chart breaks down the three pieces of the puzzle you'll need to pull together.

Each of these elements builds on the last, turning individual transaction data into a long-term metric that can completely change how you approach your ad performance.

Putting the CLV Formula into Action

Let's walk through a real-world example to make this concrete.

Imagine you run an e-commerce store that sells premium coffee beans. After digging into your data (like we covered in the last section), you come up with these numbers:

Average Purchase Value: $50

Purchase Frequency: 4 times per year

Average Customer Lifespan: 3 years

Now, we just plug these into our formula.

$50 (APV) × 4 (Frequency) × 3 (Lifespan) = $600 CLV

This $600 figure is a game-changer. It tells you that, on average, every new customer you bring in is worth $600 in revenue over their entire relationship with your brand.

This isn't just a math exercise; it's the foundation for your entire customer acquisition strategy. It gives you the confidence to set a target Cost Per Acquisition (CPA) that a bloated agency, obsessed with first-purchase profit, would never dare to attempt.

From CLV to a Confident Target CPA

Knowing your CLV is what separates the pros from the amateurs who are just guessing. This one metric empowers you to stop blindly following Google’s automated bid suggestions or accepting vague targets from an agency that doesn't understand your business.

Think about it. If a customer is worth $600 to you and your product has a 50% profit margin, your lifetime profit per customer is $300.

Suddenly, paying $75 or even $100 to acquire that customer through Google Ads looks like an incredibly smart investment. You're no longer scared of high CPCs because you understand the long-term payoff.

This has always been the bedrock of smart business planning. As detailed in these insights on customer lifetime value from Salesforce.com, the most common approach involves multiplying average revenue by customer lifespan and then subtracting the costs to serve them. It gives businesses a clear view of what a customer is actually worth. It’s the kind of direct, powerful logic I bring to my clients as an expert consultant—cutting through the usual agency noise to focus on what truly drives profit.

Moving Beyond Basics with Predictive CLV Insights

Nailing the simple CLV formula already puts you miles ahead of competitors who are still just guessing. But to really get an edge with your Google Ads, you need to look forward, not just back.

This is where predictive CLV comes in, and it's a powerful tool that slow-moving, overpriced agencies often completely miss because they lack the individual specialization to implement it effectively.

Instead of treating every customer like a statistical average, predictive models help you see that some relationships are exponentially more valuable than others. It's about moving past historical data to forecast what customers will actually do next.

Think of it this way: are you driving while looking in the rearview mirror, or do you have a clear map of the road ahead? As a consultant obsessed with efficiency, this proactive strategy is exactly how I help clients squeeze every last drop of value from their ad spend.

Why Churn Rate Is Your Secret Weapon

The key ingredient in any good predictive CLV model is churn rate—the percentage of customers who stop buying from you over a specific period.

Factoring in churn transforms a simple calculation into a sophisticated forecast. It forces you to acknowledge the reality that not all customers will stick around forever, which is critical for making realistic projections.

By understanding how quickly different customer segments leave, you can paint a much more accurate picture of future revenue. This is the foundation for smarter, more strategic decision-making.

This is where you gain a true competitive edge. You can pinpoint your most loyal customer segments and, just as importantly, identify those at high risk of churning. This is the data you need for surgical precision in your retention and remarketing campaigns—a level of detail often overlooked by large, generalist agencies.

Predictive CLV models use advanced analytics to estimate the expected lifespan of a customer based on their likelihood to churn. The result? Forecasts that are actually reliable. These models can improve the accuracy of CLV estimates by up to 30% compared to old-school methods.

For a business where a single customer is worth £4,450 over a decade, that boost in accuracy has a massive impact on your budgeting and strategy.

Activating Predictive Insights for Your Ads

Armed with this forward-looking data, your Google Ads strategy becomes far more potent. You can finally move beyond basic targeting and start allocating your budget with some real intelligence.

As you get comfortable with CLV, leveraging predictive analytics in marketing is the next logical step to sharpen your forecasting and strategic planning.

Here’s how we can put it to work right away:

Segment Your Audiences: Create remarketing lists in Google Ads for "High-Value Customers" and "At-Risk Customers." Simple, but effective.

Tailor Your Messaging: Serve your loyal customers ads for new products or loyalty perks. For the at-risk group, deliver targeted win-back offers or reminders of why they chose you in the first place.

Adjust Your Bids: Bid more aggressively to reach lookalike audiences that mirror your most valuable, low-churn customers. Don't waste money chasing clones of your worst customers.

This is the kind of specialized, profit-focused work that gets lost in the shuffle at a big agency. By focusing on predictive insights, we turn your CLV from a simple metric into a dynamic tool for driving long-term growth.

Applying CLV to Outsmart Your Competition on Google Ads

Figuring out your Customer Lifetime Value is a great start, but that number is just data until you put it to work. This is where we turn a powerful insight into a real competitive edge, leaving those cookie-cutter agency strategies in the dust.

So many businesses—especially ones stuck with big, slow-moving agencies—are trapped in a first-purchase mindset. They’re terrified to bid on expensive, high-intent keywords because their simple models only see the immediate return. I see this as a massive opportunity for smart businesses like yours.

When you know a customer is actually worth $600 over their lifetime, you can confidently and profitably outbid competitors who think that same customer is only worth $50 today.

Setting Smarter Bidding Goals

Your CLV calculation is the secret to setting aggressive—but still profitable—goals inside your Google Ads account. Forget the generic target Cost Per Acquisition (CPA) or Return On Ad Spend (ROAS) goals that most agencies pull from industry averages. We're going to use your actual business data.

Here’s how we translate CLV into auction-winning targets:

CLV-Based Target CPA: If your CLV is $600 and your profit margin is 50%, then your lifetime profit per customer is $300. This means you could set a target CPA of $100 or even more and still be wildly profitable in the long run. Your competitors, fixated on that first sale, would never dream of bidding that high.

CLV-Based Target ROAS: Instead of chasing a crazy-high ROAS on the first purchase, you can aim for a more sustainable goal based on lifetime revenue. A 200% ROAS on an initial $50 sale might look weak on paper, but if it gets you a $600 customer, it’s a brilliant move.

This is a fundamental shift in strategy. It's not about spending more money; it's about spending smarter by investing in customers you know will pay dividends over time.

Finding and Targeting Your Best Customers

The next move is to pinpoint your high-CLV customer segments and then build dedicated campaigns to find more people just like them. Dig into your CRM or sales data. Do customers who buy a certain product first tend to have a higher lifetime value? Do people from a specific city stick around longer?

The whole point is to build a detailed profile of your ideal, high-value customer. Once you know who they are, you can use Google's powerful audience targeting to find them. This gives you a massive advantage over agencies just running broad, untargeted campaigns.

More advanced CLV models will often bake in variables like acquisition costs and retention rates to give you an even sharper picture. Bringing these into the mix gives you a much more accurate CLV, especially for businesses with long customer lifecycles and significant upfront costs. You can get more insight into how these calculations work on CMSWire.com.

This screenshot from CMSWire really breaks down the core pieces that feed into a solid CLV calculation.

The image shows how average purchase value, purchase frequency, and customer lifespan all come together to create the final CLV metric. It’s all about turning abstract data into an actionable number. This is the playbook for turning a metric into a weapon and dominating the ad auction.

Common Questions About CLV and Google Ads

When business owners start moving away from a basic ad spend model and toward a smarter, CLV-driven approach, a few questions always pop up. Here are the practical, no-nonsense answers you need—the kind of direct advice you get from a dedicated consultant, not a bloated agency juggling dozens of clients.

How Often Should I Recalculate CLV?

A great rule of thumb is to recalculate your CLV quarterly or semi-annually. This rhythm is frequent enough to catch shifts in customer behavior, pricing, or new product offerings without turning into a massive chore. It keeps your data fresh and your strategy sharp.

That said, if you make a major business change—like launching a new subscription model or a flagship product—it’s smart to recalculate sooner. This lets you immediately see how the change impacts your customers' long-term value and adjust your Google Ads bids to match.

What If I Have Limited Historical Data?

This is a classic hurdle for new businesses, but it shouldn't stop you from getting started. An agency might tell you to wait for a year of data, but that just means a year of guessing on your ad spend. As a hands-on consultant, I know you need to be more agile than that.

Instead of waiting, you can begin with industry benchmarks for metrics like customer lifespan and purchase frequency in your specific niche.

Start with an educated estimate and refine it over time. Once your business has been running for 6-12 months, you’ll have your own data to work with. Then you can start swapping out the benchmarks for your actual, more accurate numbers.

Can I Use CLV for a Lead Generation Business?

Absolutely. The principle is exactly the same, you just need one extra step in the calculation. It’s a concept that agencies focused purely on e-commerce often stumble over, but it's pretty straightforward.

First, figure out your lead-to-customer conversion rate. For example, maybe 1 in every 10 leads becomes a paying customer.

Next, calculate the average lifetime value of a single paying customer. Finally, you just multiply that customer's value by your conversion rate to find the true value of one lead.

Example: If a customer is worth $5,000 to you and you convert 10% of your leads, then each lead is effectively worth $500.

This simple math tells you exactly how much you can afford to pay per lead in your Google Ads campaigns while staying highly profitable. Nailing down these nuances is a core part of learning how to measure advertising effectiveness beyond just looking at surface-level metrics.

Ready to stop guessing and start making data-driven decisions with your Google Ads? As an expert consultant, Come Together Media LLC provides the one-on-one strategic guidance that large, over-priced agencies can't match. Schedule your free, no-commitment consultation today.

Comments