PPC Competitor Analysis: Outsmart Your Rivals with a Specialist's Edge

- Chase McGowan

- Oct 4, 2025

- 15 min read

PPC competitor analysis is the systematic process of dissecting your rivals' paid search campaigns to uncover their strengths, weaknesses, and overall strategy. It's not about blind imitation; it's about gathering actionable intelligence on their keywords, ad copy, and landing pages to build a smarter, more profitable campaign for yourself. The goal is to understand the why behind their results so you can strategically outmaneuver them.

Why Your Agency's PPC Competitor Analysis Isn't Working

Let's be direct. The so-called "competitor analysis" you get from a large, bloated agency is rarely a real strategy. More often than not, it's a generic, automated data dump—a fancy-looking report packed with surface-level metrics that fail to provide any real direction. They check a box, but they don't move the needle.

This approach is flawed because large agencies are built on standardized processes and junior account managers. They lack the deep, hands-on expertise to see the full strategic picture. They can tell you what your competitors are doing, but they almost always miss the crucial why it's working (or not working).

The Problem with a Surface-Level View

An automated agency report might flag that a competitor is bidding on a new keyword. That’s a start, but it's only 10% of the story. What that report won't tell you is the critical nuance behind the data. Is their ad copy resonating with a specific customer pain point? Is their landing page converting exceptionally well due to a compelling offer or a superior user experience?

A spreadsheet can't answer those questions.

This is where an individual, expert consultant provides a decisive advantage. My entire value proposition is moving beyond the raw data and into strategic interpretation. Instead of just handing you a list of keywords, I dissect your competitor’s entire customer journey to find real, actionable intelligence.

I'm focused on things like:

Ad Messaging Nuances: What emotional triggers are they pulling? Are they hammering a unique selling proposition that the rest of the market has overlooked?

Landing Page Weaknesses: Are their calls-to-action weak and uninspired? Does their page load at a snail's pace? Is it a nightmare to navigate on a smartphone?

True Bidding Intent: Are they just carpet-bombing keywords to grab market share, or are they surgically targeting high-intent, bottom-of-funnel terms with precision?

A great PPC competitor analysis isn't about mirroring your rival's campaigns. It’s about building a smarter, more efficient strategy by understanding their strengths and—more importantly—finding their exploitable weaknesses.

A Focused Approach Delivers Real Results

A bloated agency is a machine built for volume, not expertise. Juggling dozens of clients means they rely on standardized, assembly-line processes. This model makes it impossible to perform the deep-dive required for a game-changing competitor analysis. They simply don't have the time or the specialized focus.

As a dedicated consultant, my approach is the complete opposite. I immerse myself in your specific market and treat your business as if it were my own. This singular focus allows me to spot the subtle opportunities and threats that larger, less specialized teams are structurally designed to miss. It's a key reason why an expert consultant outperforms most lead generation marketing agencies. This hands-on, expert-led method creates a nimble PPC strategy that directly impacts your bottom line.

The paid search world is increasingly competitive. With the global market projected to hit $351.5 billion in 2025, your rivals are pouring money into new platforms and AI tools. In this environment, a generic, surface-level analysis from an agency isn't just lazy—it's a surefire way to burn your ad budget.

Finding Your Real Competitors in the Ad Auction

One of the biggest mistakes businesses make is assuming their main offline rival is also their biggest threat on Google Ads. A large agency might make this same lazy assumption.

That local shop down the street might be your direct competitor for foot traffic, but in the digital ad auction, you could be fighting a different war against a national brand with a massive budget. It’s a critical distinction that process-driven agencies often gloss over.

Identifying who you’re actually competing against for clicks is the real first step. This requires shifting from a broad business view to a precise, auction-level one. Without that clarity, you're flying blind and wasting money fighting battles you don't even need to win.

Going Beyond the Obvious with Auction Insights

The first place I look is right inside your Google Ads account: the Auction Insights report. This isn’t a third-party estimate; it’s direct data from Google telling you who is showing up in the exact same auctions as you. It's the most honest picture of your immediate ad rivals.

This report provides the key metrics needed to paint a clear picture of the competitive landscape:

Impression Share: How often did another advertiser's ads appear when yours did? A high number signals a frequent, direct competitor.

Overlap Rate: What percentage of the time was their ad shown at the same time as yours?

Position Above Rate: How often was a competitor’s ad shown in a higher position than yours when you both appeared?

Top of Page Rate: How frequently did their ad appear at the top of the search results?

As an expert consultant, I don't just report these numbers. I interpret the story they tell. A competitor with a high impression share but a low position above rate might be bidding just enough to be seen, not to dominate. Conversely, a rival with a consistently high top of page rate is an aggressive player you need to watch closely.

To get ahead, understanding [what impression share is and how to boost it](https://www.cometogether.media/single-post/what-is-impression-share-boost-your-ad-performance-today) is fundamental to winning these auctions.

Uncovering Your Keyword-Level Competitors

Auction Insights gives a high-level view. The real strategic gold is found by digging deeper to identify your "keyword-level competitors." These are the advertisers who may not compete with you across the board but challenge you fiercely on your most valuable, high-intent keywords.

This is where a specialist’s focused approach smokes a bloated agency’s standardized process. An agency will run a generic report and move on. I use third-party tools like Semrush or SpyFu to zero in on specific keyword groups and identify who is really driving up the bids.

Real-World Scenario: I worked with a local HVAC company obsessed with two other local businesses. My deep-dive analysis revealed their biggest competitor wasn't another HVAC company at all—it was a national lead-generation website with a multi-million dollar budget outbidding everyone on emergency terms like "AC repair near me."

This discovery completely changed our strategy.

We couldn't win a bidding war on those hyper-competitive terms. So, we shifted focus to more specific, long-tail keywords the national aggregator was ignoring, like "install new Trane thermostat [town name]."

This pivot allowed us to find less competitive, highly profitable pockets in the market—a strategic move a generalist account manager juggling dozens of clients would likely miss. They see competitors; I see the battlefield. And finding the right place to fight is how you win.

Decoding Competitor Ad Copy and Landing Pages

Winning in Google Ads is about much more than just bidding on the right keywords. Keywords get you into the auction, but it’s your ad copy and landing page that close the deal.

This is where an expert analysis moves beyond a simple data dump. A bloated agency might run a tool and hand you a spreadsheet of your competitor's ad headlines. I don't do that. I manually review their ads to understand the story they’re telling. It’s not just about what they say; it's about understanding why they’re saying it and who they're trying to reach.

Deconstructing Competitor Ad Copy

Your competitor’s ad copy is a billboard for their core value proposition. To beat them, you have to deconstruct that message. I'm always looking for the emotional triggers and logical arguments they use to earn the click.

Here’s my method for dissecting their ads:

Unique Selling Points (USPs): What are they really selling? Is it price ("50% Off"), speed ("Next-Day Service"), quality ("Handcrafted"), or social proof ("#1 Rated")? This reveals their perceived strength.

Emotional Triggers: Is their language based on fear ("Don't Risk a Breakdown"), desire ("Achieve Your Dream Home"), or urgency ("Limited Time Offer")? Finding these hooks shows how they connect with customer pain points.

Ad Extension Game: Are they using every possible ad extension? A competitor with fully utilized sitelinks, callouts, and image extensions has a massive visual advantage—a detail an overworked agency manager often overlooks.

This isn't about stealing their ads. It’s about spotting the gaps. If every competitor is screaming about low prices, you can zig where they zag and focus your copy on superior quality or white-glove service. This is a crucial part of writing ad copy that actually converts because it makes you stand out.

The goal is to spot their strengths so you can neutralize them and find their weaknesses so you can exploit them. If every competitor uses the same generic call-to-action, a creative and compelling one in your ad can dramatically boost your click-through rate.

Following the Click to the Landing Page

An ad makes a promise; the landing page must deliver. A high click-through rate means nothing if the landing page is a letdown. This is often the weakest link in a campaign, especially when a busy agency treats landing page optimization as an afterthought.

When I analyze a competitor’s landing page, I put myself in the shoes of a skeptical customer.

Message Match: Does the landing page headline reflect the ad's promise? Any disconnect is a primary cause of high bounce rates.

Call-to-Action (CTA): Is the CTA obvious and compelling? Or is it buried below the fold? Vague or multiple CTAs kill conversions.

Social Proof & Trust Signals: Are they using testimonials, case studies, or trust badges effectively? A lack of social proof is a massive weakness you can exploit.

User Experience (UX): How fast does the page load? Is it a nightmare on mobile? A slow, clunky page is a gift—it sends frustrated users right back to Google, where your superior ad is waiting.

As search ad costs climb, a leaky landing page is an expensive mistake. The average cost-per-click is now $2.69, and advertisers are relying on engaging formats like Responsive Search Ads (RSAs) to get results. A superior landing page experience is how you make every expensive click count.

Competitor Funnel Weakness Analysis

I use a simple framework to score a competitor’s funnel and pinpoint exactly where their strategy is falling apart—and where you can strike.

Funnel Component | What to Look For (Potential Weakness) | Actionable Insight for Your Campaign |

|---|---|---|

Ad Copy | Generic headlines, no clear USP, weak call-to-action, lack of emotional appeal. | Write hyper-specific, benefit-driven headlines. Test a unique CTA. Hit on a pain point they ignore. |

Ad Extensions | Missing sitelinks, callouts, image extensions, or structured snippets. | Max out all relevant ad extensions to dominate more SERP real estate and improve CTR. |

Landing Page Headline | Headline doesn't match the ad copy (poor message match). | Ensure your landing page headline directly reflects the ad's promise for a seamless user journey. |

Landing Page Content | Vague benefits, long blocks of text, no social proof (testimonials, reviews). | Add powerful customer testimonials, a clear list of benefits, and break up text for scannability. |

Call-to-Action (CTA) | CTA is buried, uninspiring ("Submit"), or has too much friction (long forms). | Use a strong, action-oriented CTA above the fold. Simplify your form to only the essential fields. |

Mobile Experience | Slow load time, hard-to-read text, elements are not clickable. | Prioritize mobile-first design. Compress images and ensure all buttons are easily tappable. |

By methodically breaking down their funnel, you turn their weaknesses into your strengths. These are the opportunities a true consultant is trained to find—and the same ones a volume-focused agency is structured to overlook.

Once you’ve broken down their ad copy and landing pages, it's time to dig into the core of their paid search operation. We're moving past their messaging and starting to reverse-engineer their budget and priorities. This is exactly where a sharp consultant can find and exploit opportunities that a slower, bloated agency will completely miss.

This isn’t about just downloading a keyword list from a tool like Semrush or SpyFu. An agency might hand you that spreadsheet and call it a day. A real specialist, though, uses that data as a starting point to decipher the story behind their strategy.

Distinguishing Money Keywords from Exploratory Terms

Not all keywords are created equal. Your competitors are spreading their budget across a whole portfolio of terms, and you need to understand the role each one plays. I like to split their keywords into two main buckets to figure out what they're really after.

'Money' Keywords: These are the high-intent, bottom-of-the-funnel terms that drive sales right now. Think phrases with words like "buy," "service," "quote," or specific product models. This is where your competitors are almost certainly concentrating their budget and bidding aggressively.

Exploratory or Long-Tail Keywords: These are usually longer, more descriptive phrases that catch people earlier in their research. A competitor bidding here is probably testing out new market segments or trying to grab traffic before it gets more expensive.

Sorting them this way reveals their core strategy. A heavy investment in money keywords means they're all about immediate ROI. A broad mix of long-tail terms suggests they're playing the long game, building awareness and capturing leads early.

For a consultant or a smaller business, the gold is often in the gaps. If a big, well-funded competitor is ignoring a specific set of high-intent but low-volume long-tail keywords, that's your opening. You can jump into that auction and win conversions without needing a massive budget.

To get this done right, you need the right tech. For a solid rundown of options, you might want to look into the best competitive intelligence software tools to make your data gathering a whole lot easier.

Analyzing Ad Spend to Reveal Strategic Priorities

Estimating their ad spend is where this analysis gets really powerful. Tools can give you an estimated cost-per-click (CPC) and traffic volume for each keyword, letting you piece together where their budget is actually going. By multiplying the estimated clicks by the estimated CPC, you can pinpoint which keywords are eating up the biggest slice of their monthly ad spend.

This isn't about getting a perfectly accurate number; it’s about understanding the proportions. If 70% of their budget is going into just 10% of their keywords, you've just found the terms they consider non-negotiable. It tells you exactly where their priorities are and which keywords they'll fight tooth and nail to defend.

That’s a critical insight. Knowing which terms are their cash cows helps you decide: do you compete head-on (if you have a better offer), or do you put your budget into the underserved areas they've deemed less important?

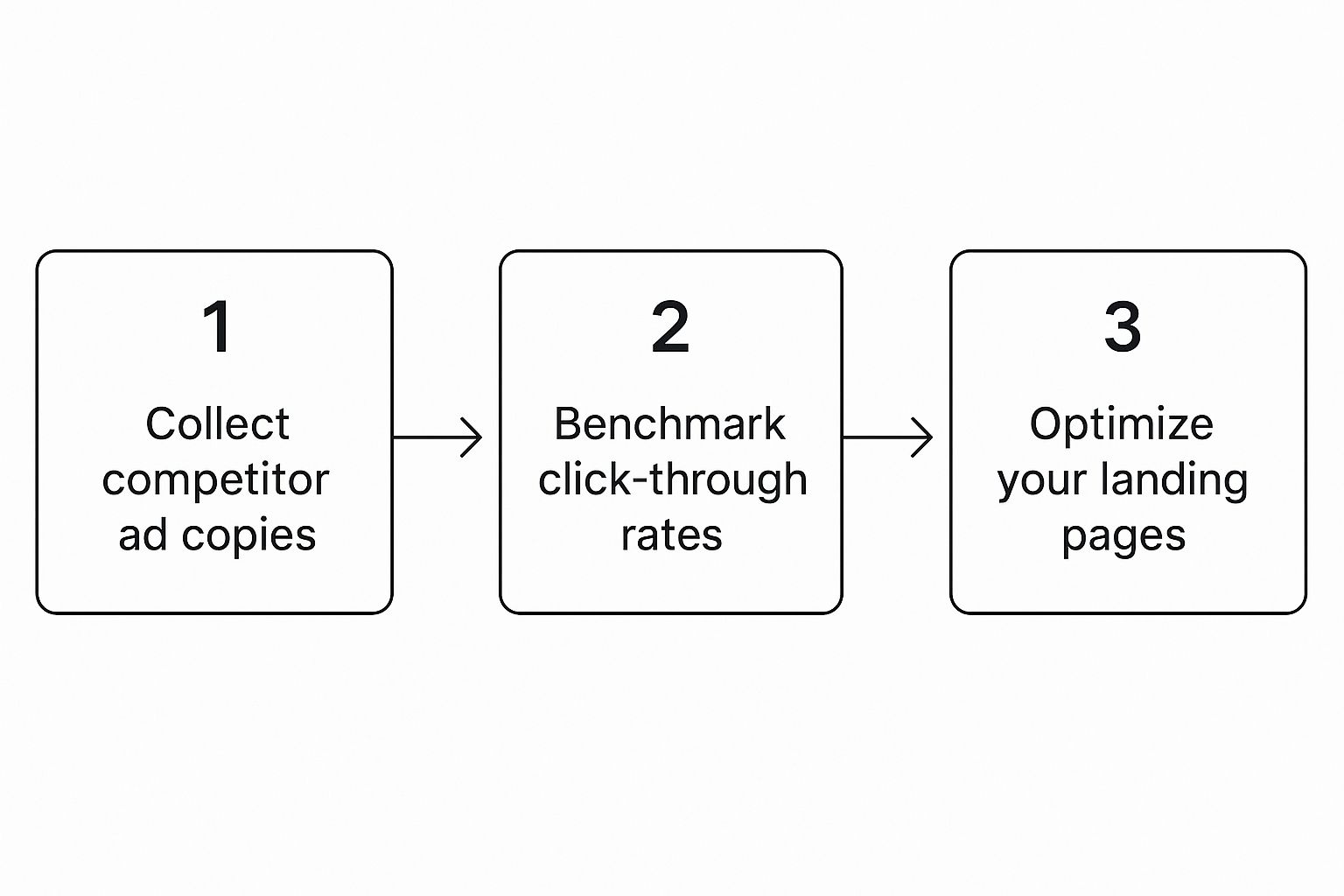

This infographic breaks down a simple flow for using this competitor data to fuel your own campaigns.

As you can see, collecting the data is just step one. The real value comes from benchmarking and then optimizing your own campaigns based on what you find.

Spotting Patterns in Ad Scheduling and Device Targeting

The last layer of this deep dive is figuring out when and where your competitors are spending their money. A big, slow-moving agency often just sets campaigns to run 24/7 across all devices because it's easier. Their laziness creates massive opportunities for you.

Here are the specific patterns I hunt for:

Ad Scheduling: Are their ads only running hard during standard business hours (e.g., 9 AM to 5 PM, Monday-Friday)? This is a common blind spot for B2B services, leaving the weekends and evenings wide open for you to snap up leads at a lower cost.

Device Targeting: Is their bid on mobile way lower than on desktop? This might mean they have a clunky mobile landing page, giving you a perfect opening to outrank them with a mobile-first approach.

These insights are pure strategic fuel. For instance, if you see a competitor shuts off their ads at 5 PM, you can schedule a modest budget increase from 5:01 PM onward and scoop up all the evening search traffic they're just leaving on the table. It’s a surgical move that exploits a competitor’s operational blind spots—the kind of agility a big agency just can't match.

Turning Your Analysis into a Winning Strategy

All that data we just gathered? It's just noise until you shape it into a concrete plan. This is where the rubber meets the road—and it's the single biggest difference between working with a hands-on consultant and an oversized, process-driven agency. They'll send you a report; I'll build you a roadmap.

Synthesizing these findings isn't about creating a laundry list of things to do. It’s about being ruthless with prioritization. We're hunting for the moves that will deliver the quickest wins while setting you up for long-term, sustainable growth.

Identifying and Owning Keyword Gaps

First up: we go after the underserved keyword gaps we found. These are the profitable little pockets in the market where your competitors are either completely absent or just phoning it in. A bloated agency often misses these because they're chasing the same high-volume, obvious keywords that look good on a spreadsheet but cost a fortune.

We'll build a surgical strategy around these gaps:

Target Low-Competition, High-Intent Keywords: We already found the terms your competitors are ignoring. We’ll build hyper-specific ad groups around them to capture this ready-to-buy traffic.

Capitalize on Their Ad Schedule: Did we discover they turn off their ads every day at 5 PM? Fantastic. We'll strategically boost our bids during their off-hours to completely own the evening search traffic.

Exploit Device Weaknesses: If their mobile experience is a clunky mess, we’ll double down on a mobile-first campaign. Think targeted bids and a seamless landing page designed to scoop up all the users they’re frustrating.

This is about being smarter with your budget, not just throwing more money at the problem—a level of agile management a big agency simply can't match.

Crafting Superior Ad Copy and Offers

Okay, now let's talk about the messaging weaknesses we uncovered. Your competitors have laid their playbook bare—their value props, their emotional triggers, and their calls to action. We’re going to use that intel to write ad copy that doesn't just compete, but completely dominates the click.

This means creating ads that speak directly to the pain points your rivals are ignoring. If they all scream about "low prices," we’ll hit them with "24/7 support" or "guaranteed results." We’ll A/B test headlines that challenge their entire value proposition head-on.

This is where a consultant's personal touch makes all the difference. I'm not just a campaign manager; I'm a strategist who gets inside the mind of your customer to write copy that actually resonates—something an overworked agency rep juggling 30 other clients just doesn't have time for.

Building Landing Pages That Convert

A brilliant ad that leads to a terrible landing page is like a great movie trailer for a bad film—it just creates disappointment and wastes money. The final piece of the puzzle is building landing pages that are laser-focused on one thing: converting the traffic our superior ads are about to drive.

Our analysis of their funnels showed us exactly where the weak spots are.

Weak CTAs? We’ll use strong, unmissable calls-to-action right above the fold.

No Social Proof? Your pages will feature your best testimonials and reviews prominently.

Poor Mobile UX? We'll make sure your pages are lightning-fast and flawless on every single mobile device.

These aren't just technical fixes; they're strategic moves designed to exploit the conversion gaps your competitors have left wide open. This is a dynamic strategy that requires constant testing and tweaking, not a "set it and forget it" agency approach. For anyone just getting started, understanding how these PPC tactics fit into the bigger picture is key, which is why learning about foundational digital marketing concepts can be so valuable.

When you put all these pieces together—the right keywords, killer ad copy, and high-converting landing pages—you get a powerful, cohesive strategy. It turns your competitor analysis from a simple academic exercise into a definitive plan for outmaneuvering your rivals and growing your business.

Answering Your Top PPC Competitor Analysis Questions

When you start digging into what your competitors are doing with their paid ads, it's easy to get lost in the weeds. It often brings up more questions than answers, especially when you're trying to find a real, actionable edge.

Let's cut through the noise. Here are the most common questions I hear, along with the kind of straightforward, practical answers you'd get from a specialist who's been in the trenches—not the bloated, generic advice you'd get from a big agency.

How Often Should I Really Be Checking on Competitors?

This is a big one. The standard agency answer is "quarterly" because it lines up perfectly with their reporting schedule. Frankly, that's a huge mistake. The paid search world moves way too fast for that.

A smarter approach is a dynamic one. I always recommend a deep-dive analysis every quarter to get a solid read on their overarching strategy. But you absolutely need to keep a monthly pulse check on their ad copy and any significant new keywords they're testing.

For my clients' most critical, high-spend campaigns, I'm in the Auction Insights report weekly. This hands-on, frequent monitoring means we can make agile adjustments on the fly—something an overworked agency account manager juggling 30 different clients just can't do.

The right frequency isn't about a rigid schedule; it's about matching your monitoring to the pace of the auction. An agency's quarterly report is a snapshot of the past; a consultant's continuous monitoring is a roadmap for the future.

Can I Actually Trust the Data from Spy Tools?

Tools like Semrush and SpyFu are incredibly powerful, but you have to know what you're looking at. Their data—especially numbers like ad spend—is an educated estimate, not gospel. Remember, they don't have a backdoor into your competitor's Google Ads account.

An agency might slap these numbers into a fancy report and present them as hard facts. A seasoned pro knows better. The real value isn't in the exact dollar amount but in the proportions and trends.

Is their estimated ad spend heavily skewed toward just a handful of keywords? That's a huge clue pointing to their "money" terms.

Did their estimated traffic for a specific keyword group suddenly spike? They probably launched a new offer or a landing page you need to go investigate.

Think of these tools as providing all the puzzle pieces. A big agency might just dump the box on your desk. My job is to actually assemble those pieces to reveal the full picture of their strategy.

What If My Competitor Has a Much Bigger Budget?

This is the fear I hear most often, and it’s where a specialist's strategy truly makes a difference. Trying to outspend a massive competitor is a game you'll always lose. The key is to outsmart them.

A big, slow-moving agency often just throws more money at problems, which creates huge blind spots a nimble competitor can exploit.

Here’s how we win that fight:

Go Granular: We hunt down long-tail, high-intent keywords they consider too small to bother with. These are almost always cheaper and have much higher conversion rates.

Focus on Profit, Not Volume: A large competitor might be obsessed with impression share and vanity metrics. We focus entirely on Return On Ad Spend (ROAS), even if it means getting less overall traffic. Profitability is the goal.

Exploit Their Weaknesses: From our earlier analysis, we already found their weak landing pages, generic ad copy, and lazy 9-to-5 ad schedules. We can now methodically attack those gaps with superior messaging and smarter timing.

Beating a bigger competitor isn't about having a bigger wallet. It's about being more agile, more creative, and more strategic—the core advantages you get when working with a dedicated consultant over a cumbersome agency.

Ready to stop guessing and start outmaneuvering your competition? As an expert Google Ads consultant, Come Together Media LLC provides the deep, personalized analysis and agile strategy that bloated agencies can't match. Book a free, no-commitment consultation today to uncover your biggest opportunities.

Comments