PPC Competitive Analysis That Outsmarts Bloated Agencies

- Chase McGowan

- Oct 25, 2025

- 18 min read

A proper PPC competitive analysis is about way more than just pulling a list of your rivals’ keywords. It's about an expert digging into their entire paid search strategy to find strengths, weaknesses, and—most importantly—opportunities you can jump on.

This isn't about running an automated report. It's about figuring out why their ads are working, how they're structuring their offers, and where their customer journey breaks down. This is the kind of deep, hands-on work that bloated agencies don't do, and it gives you a clear roadmap to beat them in the ad auction.

Why Your Agency's Analysis Is Holding You Back

Let's be blunt. That templated PPC competitive analysis your big, overpriced agency sends over is usually just a surface-level report. It’s designed to look impressive on an invoice, not to deliver any real strategic value that grows your bottom line.

They plug your domain into some expensive software, slap a logo on the automated output, and call it "insight." This whole approach is broken because it completely misses the nuances that actually win ad auctions—nuances that only a dedicated expert can spot.

These "data dumps" totally ignore the human element:

Competitor Psychology: Why are they really bidding on those terms? What specific fear or desire is their ad copy tapping into? A machine can't tell you this.

Ad Copy Angles: Are they leading with a low price, a unique feature, or a strong value proposition? An agency juggling 50 accounts won't take the time to deconstruct the emotional trigger that's actually connecting with your audience.

Landing Page Friction: Once a user clicks, is the path to conversion seamless? Or is the page confusing, slow, and full of dead ends? An automated report from a bloated agency will never analyze that user experience with the eyes of a conversion expert.

As an individual, expert consultant, this is the world I live in. My edge isn't a bigger software budget or a fancy office; it's the hands-on, strategic thinking and individual specialization that bloated agency structures simply can't match.

The Consultant's Edge Over the Agency Model

The real difference comes down to individual specialization versus generalization. A big agency has siloed teams—one for SEO, one for social, and a PPC team where junior account managers juggle dozens of different accounts. Your business gets a tiny fraction of a generalist's attention, and the "analysis" is whatever the software spit out that week.

An expert consultant, on the other hand, is your dedicated strategist. I’m not just glancing at your account between meetings; I’m deep in the trenches, analyzing the entire competitive landscape every single day. The insights I deliver don't come from a template; they're the result of me meticulously deconstructing your rivals' funnels, piece by piece.

To get past mediocre results, you have to master PPC competitive analysis with an expert who can arm you with the knowledge to outsmart your competition, not just outspend them.

Let's break down the two approaches. The difference in mindset and outcome is stark.

Agency Report vs Expert Analysis: A Quick Comparison

Analysis Aspect | Bloated Agency Approach | Expert Consultant Approach |

|---|---|---|

Data Source | A single, expensive SaaS tool export | Cross-referenced data from multiple sources, plus manual, expert SERP analysis |

Core Focus | Reporting on what competitors are doing | Uncovering why they're doing it and finding strategic gaps only a specialist can see |

Output | A polished PDF filled with charts but no real plan | An actionable roadmap with specific recommendations and test hypotheses |

Key Question | "What keywords are they bidding on?" | "What is their entire customer acquisition funnel and where is it weak?" |

Frequency | Monthly or quarterly "check-in" | Continuous, real-time monitoring and adjustment from your dedicated specialist |

This table shows it's not about having more data—it's about having the right insights. An agency report looks backwards; a true expert analysis looks forward.

Real Strategy vs. Repackaged Data

This screenshot shows the Google Ads dashboard, the engine that powers a multi-billion dollar industry.

While any bloated agency can use this platform, many just scratch the surface, focusing only on top-level metrics to justify their retainer. The real power comes from a dedicated expert using its data to build a competitive strategy that goes far beyond what a dashboard can tell you.

The stakes are enormous. The global search advertising market is projected to hit around $351.55 billion in 2025. With that much money on the line, a sharp, nuanced, and expert-led approach is the only way to avoid burning through your budget.

The goal of a real PPC competitive analysis isn't to create a report. It's to build an actionable roadmap that identifies specific, exploitable weaknesses in your competitors' campaigns, giving you a direct path to increasing market share—a level of detail over-priced agencies don't provide.

Building Your Competitor Intelligence Dossier

A powerful PPC competitive analysis isn't just a list of names. It’s a detailed dossier on every single player bidding on your keywords, and it’s the foundation of a strategy designed to win.

Most large, bloated agencies stop after identifying the three most obvious rivals. That lazy, templated approach leaves you blind to the full picture of the auction environment.

My process, as a dedicated specialist, starts with a much broader scope. I’m not just looking for the big fish; I’m hunting for the emerging threats, the niche players, and the indirect competitors who are stealing clicks from under your nose. Building this complete intelligence file is how we move from a reactive to a proactive PPC strategy.

Identifying the Full Spectrum of Competitors

The first mistake most agencies make is limiting their view. They only look at direct competitors—the companies selling the exact same thing you do. This is a critical error made by generalists. The Google Ads auction is far more complex, and your budget is being drained by more than just your direct rivals.

As a specialist, I build a truly effective dossier by categorizing everyone bidding on your terms:

Primary Competitors: These are the obvious ones. They offer a similar product, at a similar price point, to the same audience. Think Asos vs. Boohoo.

Secondary Competitors: These companies solve the same core problem but with a different solution or for a slightly different audience. For a high-end electric bike company, this might be a brand that sells affordable gas-powered scooters.

Tertiary Competitors: These are brands that don't directly compete but are related to your industry and may bid on informational or top-of-funnel keywords. For that same e-bike company, this could be a blog that reviews outdoor gear.

Segmenting competitors this way gives you a much clearer understanding of who you’re really up against and why they are bidding on specific terms. To effectively structure the gathering and interpretation of this data, it helps to use a robust competitor analysis framework.

Using Smart Tools Without the Agency Price Tag

The second mistake agencies make? Relying solely on expensive, enterprise-level software suites and passing that cost on to you. These tools are powerful, but they often lead to a "set it and forget it" mentality, generating automated reports that lack strategic depth.

As an independent consultant, my advantage lies in being nimble and cost-effective. I use a curated set of tools that provide deep insights without the bloated overhead you pay for with an agency. My toolkit is built for surgical precision, not just brute-force data collection.

This approach allows me to uncover the same intelligence—and often more—than an agency charging you for their software subscription fees. It also means every dollar of your budget goes toward strategy and results, not software licenses and agency overhead.

An expert consultant doesn't need a six-figure software budget to outperform a bloated agency. They need the right tools, hands-on experience, and the individual dedication to go beyond the automated report.

To see the specific, cost-effective platforms I use to get the job done, you can explore my guide on the top PPC competitor analysis tools to outsmart bloated agencies.

Profiling Competitor Aggression and Spend

Once you have your list, the real work begins: profiling. This is where a consultant’s manual, expert analysis truly shines over an agency’s automated export. I assess each competitor on several key axes to build a profile of their strategic intent.

I'm looking at metrics like:

Impression Share: How often are they showing up in top ad positions for your most valuable keywords? High impression share often signals an aggressive, budget-heavy strategy.

Ad Copy Tenor: Is their messaging aggressive and discount-driven, or is it focused on brand building and value propositions? This reveals their core marketing angle.

Keyword Portfolio Breadth: Are they only targeting a few high-volume "money" terms, or do they have an extensive list of long-tail keywords? A broad portfolio suggests a more sophisticated, mature PPC operation.

This manual deep-dive provides a qualitative layer of intelligence that software can't. It helps us understand not just what they are doing, but why. With this comprehensive dossier, we can begin dissecting their strategy piece by piece and craft a precise counter-attack.

Deconstructing Competitor Keyword Strategies

Keywords are the engine of any Google Ads campaign, but let's be honest: a simple keyword overlap report from a big, bloated agency is almost worthless. Sure, it tells you what your competitors are bidding on, but it completely misses the why. A real PPC competitive analysis means having an expert strategically dissect their entire keyword portfolio.

This is where my hands-on, specialist approach makes all the difference. Instead of just dumping a spreadsheet in your lap, I dig into the strategic intent behind their keyword choices. This granular analysis goes way beyond basic lists to give you a strategic map of the auction battlefield, showing you exactly where to attack for the best ROI.

Pinpointing Their Core "Money" Keywords

Every competitor has a set of keywords they absolutely rely on for most of their leads or sales. These are their "money" keywords, and you can bet they'll defend them aggressively. As your consultant, nailing these down is the first step to understanding their business priorities and where their budget is going.

An agency might just flag keywords with the highest search volume. That's lazy. I look for a combination of signals to figure out what's really driving their revenue:

High Estimated Spend: Tools can give us a rough idea of which terms are eating up most of their budget.

Consistent Top-of-Page Presence: If they're constantly glued to the top one or two ad spots for a specific term, that's a dead giveaway it’s a high-priority keyword.

Commercial Intent: Keywords loaded with terms like "buy," "pricing," "service," or specific product model numbers are strong indicators of bottom-of-funnel traffic they simply can't afford to lose.

By zeroing in on these terms, we get a clear picture of their PPC strategy's foundation. From there, we can decide whether to compete head-on, find a cheaper alternative, or sidestep the term entirely if the cost-per-click is just too inflated.

Beyond the Obvious: Long-Tail and Niche Opportunities

While money keywords are critical, the real gold is often hiding in the long-tail. These longer, more specific search queries have lower search volume, but they almost always have much higher conversion rates. Big, bloated agencies often miss these because their automated tools are programmed to chase high-volume terms.

I manually dig into the niche corners of their keyword strategy to find where they're capturing highly qualified—but less obvious—traffic. This means looking for patterns. Are they targeting specific pain points? Geographic locations? Unique customer segments?

For example, a competitor might be all-in on "emergency plumber," but a deeper look might show they're also quietly capturing traffic from "leaky pipe under sink fix" or "how to stop a running toilet." These are high-value opportunities that a surface-level agency analysis will always miss. Uncovering them allows us to intercept their customers with more specific and helpful ad messaging. For a more detailed guide, you can learn more about how to find competitor PPC keywords and win with an expert, not a bloated agency.

The biggest wins in a PPC competitive analysis don't come from copying your competitor's most expensive keywords. They come from an expert finding the profitable, underserved keyword gaps their bloated agency has either ignored or mismanaged.

Here's a look at the kind of top-level data you can get from a tool like Semrush.

This dashboard is a great starting point, but it's just raw data. The real insight—the kind you pay a consultant for—comes from interpreting this data to understand their bidding behavior and strategic priorities. It's the story behind the numbers that matters.

When you're digging through a competitor's keyword list, you're not just looking for terms to copy. You're looking for strategic clues. The table below breaks down what different types of keywords can tell you and how an expert turns that intel into action.

Actionable Insights From Competitor Keywords

Keyword Type Found | What It Tells You | Your Strategic Action |

|---|---|---|

High-Spend "Money" Keywords | These are their core revenue drivers. They are confident in their conversion rates for these terms. | Analyze their ad copy and landing pages for these keywords. Decide if you can compete on offer/price or if you should find a lower-cost alternative. |

Branded Keywords (Not Yours) | They are actively bidding on their own brand name to defend against competitors (like you). | This is a defensive, high-cost strategy for them. Consider a targeted campaign on their brand name if you have a superior offer. |

Long-Tail Question Keywords | They're targeting users early in the buyer's journey who are looking for information, not a purchase. | Intercept this traffic with helpful content-driven landing pages or lead magnets. You can capture leads before they're even aware of your competitor. |

Geographically-Specific Terms | They have a strong focus on specific local markets or service areas. | If you also serve those areas, you know where to focus your geo-targeting. If not, you know where not to waste your budget. |

Competitor Brand Names | They are aggressively trying to poach customers from other specific brands in the market. | If they're bidding on your brand, you need a defensive strategy. If they're bidding on other brands, see if there's an opportunity for you to do the same. |

Each of these keyword types is a breadcrumb. By following the trail, a dedicated expert can piece together their entire go-to-market strategy and find the perfect place to strike.

Estimating Their Bidding Strategy and Aggressiveness

Finally, a deep keyword analysis should reveal their bidding philosophy. Are they all about brand awareness, or are they laser-focused on conversions? A specialist can figure this out by looking at the types of keywords they prioritize and where they show up in the auction.

Aggressive Top-of-Page Bidding: See a competitor consistently paying a premium for that #1 spot on broad, high-funnel keywords? Their goal is likely maximizing visibility and impression share. This is a very expensive way to play, and it often creates an opportunity for us to win on profitability by focusing on lower-cost, higher-converting terms.

Conversion-Focused Bidding: On the flip side, if they're more visible on long-tail, high-intent keywords but less so on general terms, it points to a strategy built squarely on ROI and lead generation.

Understanding this difference is critical. It tells you if you're up against a competitor with deep pockets playing a branding game or a savvy operator who is tracking every dollar. Each one requires a completely different counter-strategy—a nuance that a generic agency report will never give you.

Uncovering Weaknesses in Their Ad and Landing Pages

Winning in Google Ads isn’t about who has the biggest budget. It’s about who delivers a more compelling message and a smoother user journey, guided by an expert eye.

This is where I see large, siloed agency teams drop the ball time and time again. Their PPC and web design teams might as well be on different planets, leading to a disconnected experience that absolutely murders conversion rates.

As an individual consultant, I see this gap as a golden opportunity. I conduct a complete teardown of a competitor’s funnel—from the ad that grabs their attention to the landing page that’s supposed to close the deal. This is how you find the cracks in their armor, the friction points their bloated, over-priced agency is too disconnected to even notice.

Deconstructing Competitor Ad Copy

Your competitor's ad copy is a direct line into their entire marketing strategy. A lazy agency report just lists headlines. A real ppc competitive analysis from an expert gets inside their head to dissect the emotional triggers and value props they're banking on.

I meticulously break down every part of their ads to figure out their angle:

Value Proposition: Are they leading with a discount ("50% Off Today"), a unique feature ("Patented One-Click Setup"), or leaning on social proof ("Trusted by 10,000+ Businesses")? This tells you what they think their strongest selling point is.

Emotional Triggers: Is their copy pushing urgency ("Limited Time Offer"), solving a pain point ("Never Worry About Data Loss Again"), or selling a dream ("Achieve Your Fitness Goals Faster")?

Call-to-Action (CTA): Is it weak and passive like "Learn More" or strong and direct like "Get Your Free Quote Now"? A weak CTA is a dead giveaway of a phoned-in, templated campaign run by a junior employee.

This manual review uncovers the strategic patterns. You might find a top competitor relies solely on discount messaging. That’s a huge opening for you to come in with a value-focused campaign that attracts higher-quality customers who aren't just shopping for the lowest price.

The best insights don't come from a software dashboard. They come from an expert reading a competitor's ad and asking one simple question an agency never does: "Would I actually click on this, and why?"

Analyzing the Ad-to-Landing-Page Journey

Getting the click is only half the battle. The second a user hits their page, a new clock starts ticking—and this is where most agencies fail spectacularly. A PPC manager at a big firm almost never has a say in landing page design, which results in a jarring and confusing user experience.

As an independent consultant, I live for this part. I click the ads. I experience the landing pages firsthand. I’m actively looking for the critical disconnects that are bleeding their budget dry.

My funnel teardown zeros in on a few key areas:

Message Match: Does the promise in the ad headline match the headline on the landing page? If an ad screams "Free Consultation," but the landing page says "Our Services," that’s a massive red flag—and a huge opportunity for you to do it better.

Friction Points: Is the contact form buried below the fold? Does the page take forever to load on mobile? Are there a dozen distracting links pulling the user away from the one thing you want them to do?

Mobile Experience: With over 60% of search ad spending now coming from mobile, a clunky mobile page is a death sentence for conversions. I test their pages on actual phones to check button sizes, font readability, and form usability. Automated reports from a bloated agency just can't replicate that real-world feel.

This hands-on approach allows us to build a far superior experience. We can directly attack the friction we find, creating a much smoother path to conversion for our own campaigns. For a deeper dive on this, check out our expert guide to build high-converting landing pages that win and see how a cohesive strategy changes everything.

Creating Your Competitor Funnel Scorecard

To make these observations actionable, I use a simple grading system—a Competitor Funnel Scorecard. This isn’t some complicated, 50-page agency report. It’s a practical checklist to objectively rate each competitor's conversion path from an expert perspective.

You can build your own using these criteria, rating each from 1 (Poor) to 5 (Excellent):

Criterion | Competitor A | Competitor B | Competitor C |

|---|---|---|---|

Ad Copy Clarity | 4 | 2 | 5 |

CTA Strength | 5 | 3 | 4 |

Ad-to-Page Message Match | 2 | 5 | 5 |

Landing Page Design | 3 | 4 | 4 |

Mobile Usability | 1 | 5 | 3 |

Conversion Path Simplicity | 2 | 4 | 4 |

When you grade three or four competitors like this, their weaknesses become glaringly obvious. You’ll see that Competitor A has fantastic ad copy, but their landing page is a total disaster on mobile. Competitor B has a great page but incredibly weak, generic ads.

This scorecard becomes your strategic roadmap. It points directly to the low-hanging fruit and tells you exactly which part of the funnel to attack first for the fastest, most impactful wins. This is the difference between an agency data dump and a true, expert-led ppc competitive analysis.

Turning Competitive Data into a Winning Strategy

So, you've gathered a mountain of intelligence on competitor keywords, ad copy, and landing pages. This is the exact point where most big, bloated agencies stop. They'll package this raw data into a glossy report, call it "strategic analysis," and move right on to their next client.

Frankly, that's a massive failure. Data without synthesis and action is just expensive noise. The real value—the edge an individual expert consultant brings—is turning that intelligence into a concrete, actionable roadmap designed to win. It’s about transforming a data dump into a decisive battle plan.

This is the synthesis stage. It's where we connect the dots between their keyword choices, ad messaging, and landing page weaknesses to build a strategy that directly exploits the gaps their own siloed, disconnected agency teams can't see.

Crafting a Focused SWOT Analysis

The first step in building your roadmap is to organize your findings. A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is a perfect framework for this, but with a specialist's twist. Instead of some generic business overview, we’ll create a **PPC-specific** SWOT analysis based directly on the competitive data we've gathered.

This isn't a theoretical exercise for an agency deck. It’s a practical tool for translating what you've observed into strategic priorities.

Strengths: What are we already doing better than them? Maybe our mobile landing page experience is lightyears ahead, or our ad copy has a much stronger emotional hook.

Weaknesses: Where are we getting beat? Perhaps a competitor has a much higher impression share on our core "money" keywords, or their ad extensions are far more compelling.

Opportunities: These are the golden nuggets. A competitor has a clunky, multi-step checkout process. Another uses vague, passive CTAs in their ads. These are weaknesses on their side that become direct opportunities for us.

Threats: What external factors could hurt us? This might be a new, aggressive competitor entering the market or a rival who consistently outbids us on our own brand name.

Organizing your ppc competitive analysis findings this way immediately clarifies where to focus your energy and budget for the highest impact.

From Analysis to Actionable Initiatives

With your SWOT complete, the next step is to prioritize. A bloated agency might give you a laundry list of 50 "recommendations." An expert consultant helps you identify the one or two initiatives that will drive 80% of the results.

Which competitor weakness offers the quickest win? Which keyword gap promises the best return on investment?

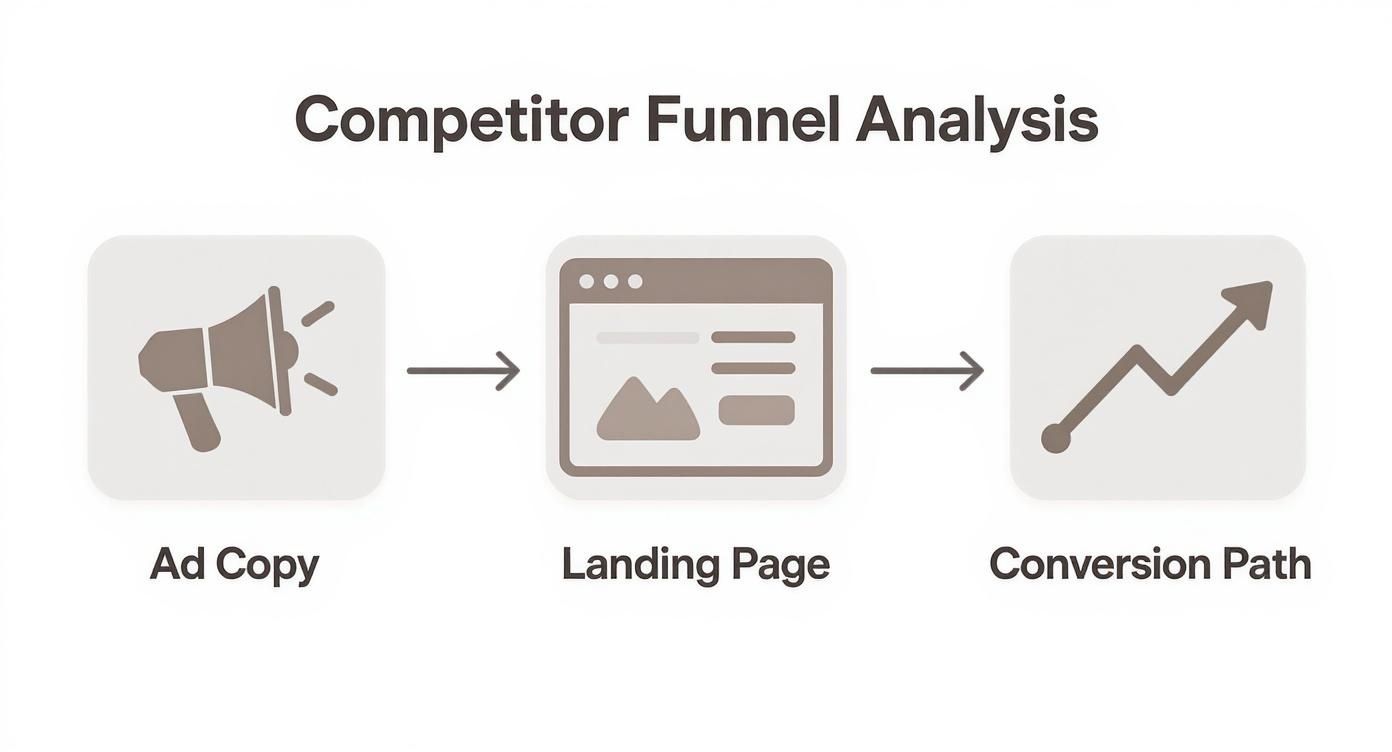

The infographic below illustrates the core steps of a competitor's funnel—from their ad copy to their landing page and final conversion path—that we analyze to find these very weaknesses.

This visualization highlights a key truth: a breakdown at any stage—unconvincing ad copy, a confusing landing page, or a difficult conversion process—creates a strategic opening for you.

From here, we craft specific, targeted campaigns. This is where the individual consultant’s advantage becomes undeniable, moving from generic advice to tailored execution.

A report tells you what happened. A strategy tells you what to do next. My goal isn't to deliver a document; it's to build a campaign that directly counters a competitor's primary value proposition or solves a pain point their bloated agency completely ignores.

For instance, if your analysis reveals your main competitor’s ads all scream "cheapest," your strategic initiative could be launching a campaign centered on "best value" or "superior quality," targeting users who are tired of low-quality options.

Or, if their landing page is a disaster on mobile, we can launch a mobile-first campaign with a perfectly streamlined landing page, bidding aggressively on mobile devices to intercept their frustrated customers. This is the kind of nimble, strategic move that large, slow-moving agencies simply can't execute effectively. You walk away with a roadmap, not just a report.

Answering Your Toughest PPC Competitor Questions

Once you’ve started peeling back the layers on competitor keywords, ad copy, and landing pages, the real questions start to surface. This is where having an experienced consultant in your corner makes all the difference—you get straight, battle-tested answers, not the canned responses from some junior account manager at a big, clunky agency.

Let's dive into the questions I hear most often from businesses ready to get serious about competitor analysis.

How Often Should I Run a PPC Competitor Analysis?

This is a big one. The standard, lazy agency answer is "monthly" or "quarterly," but that's a dangerously outdated mindset. The Google Ads auction isn't a static report; it's a live marketplace that changes by the hour. If you're only looking at it once a quarter, you're always a step behind.

My approach as your dedicated expert is built on continuous monitoring. While we might do a massive, deep-dive report quarterly, the real work happens constantly.

Weekly Pulse Checks: I’m always keeping an eye on competitor ad copy for new sales or messaging shifts. I’m also watching for any major swings in impression share on our most important keywords.

Real-Time Alerts: I have tools set up to ping me the moment a new player shows up in the auction for our money-making terms.

This level of constant vigilance is something large, bloated agencies, bogged down with too many accounts, just can't offer. They don't have the bandwidth or the specialized focus to live inside your specific market auction every day. It’s the difference between getting last month’s weather report and having a meteorologist on speed dial.

What If My Competitors Are Huge Brands with Massive Budgets?

It’s easy to get spooked when you see a household name bidding on your keywords. But here’s the secret an expert knows: their size is often their greatest weakness. A nimble, focused approach from a specialist can run circles around them.

Big corporations are notoriously slow. Their ad campaigns are often managed by siloed internal teams or handed off to equally massive, over-priced agencies where any real strategy gets watered down by committee. They tend to chase broad, high-volume keywords because it’s simple and looks impressive on a summary report.

Your advantage isn't a bigger budget—it's superior strategy and speed. A large competitor is like a battleship: powerful, but it takes forever to turn. A skilled individual consultant lets you be the speedboat, zipping around them and finding all the openings their agency is too bloated to see.

Here’s our playbook for winning against the giants:

Find Their Blind Spots: We go after the valuable long-tail keywords that their lazy broad-match strategy completely ignores.

Out-Maneuver Their Messaging: We write sharp, specific, and emotionally resonant ad copy that their generic, approved-by-committee messaging could never compete with.

Create a Better Experience: We build dedicated, lightning-fast landing pages that are laser-focused on conversion, crushing the user experience of their clunky corporate websites.

A huge budget can buy you impressions, but it can't buy the strategic precision and hands-on tweaking required to win profitable customers. That’s where an expert’s individual focus becomes your most valuable asset.

Should I Bid on My Competitors' Brand Names?

Bidding on competitor brand terms is a popular tactic, but it's rarely a slam dunk. A bloated agency might throw it in as a default "aggressive" play without thinking it through. My process as a specialist is far more deliberate.

Before I ever launch a competitor campaign, I need solid answers to two questions:

Is Your Offer Genuinely Better? If someone is searching for "Competitor X," you better have a damn good reason for them to click on your ad instead. Is your price better? Do you have more features? A stronger guarantee? If the answer is no, you're just lighting money on fire.

Can You Stomach the Low Quality Score? Google is going to (correctly) see your ad as less relevant for a competitor’s brand search. That means a lower Quality Score and higher costs-per-click. You have to be sure the math works out in your favor.

Often, a much smarter play is to target keywords that signal someone is unhappy with a competitor. Think "Competitor X alternatives" or "problems with Competitor X." This lets you capture users who are already looking for an escape hatch—a far more efficient use of your ad budget. It’s this kind of strategic thinking that separates a true expert partner from an over-priced agency just going through the motions.

Ready to stop guessing and start winning with a PPC strategy built on real competitive intelligence? As an expert Google Ads consultant, Come Together Media LLC provides the hands-on analysis and strategic execution that bloated, over-priced agencies simply can't deliver. Book your free, no-commitment consultation today.

Comments