ROI vs ROAS A Consultant's Guide to Real Profit

- Chase McGowan

- Jul 29, 2025

- 13 min read

The real debate between ROI vs. ROAS comes down to this: ROAS measures top-line revenue from ads, while ROI measures bottom-line profit from your entire investment. Getting this right is the first step toward building a truly profitable advertising strategy, separating vanity metrics from actual business growth.

The Critical Difference Between ROI and ROAS

The conversation around ROI vs. ROAS is where profitability is truly won or lost. I’ve seen too many businesses, often guided by bloated agencies fixated on flashy numbers, chase a high ROAS (Return on Ad Spend) while unknowingly losing money on every single sale.

This happens because ROAS only tells part of the story—a dangerously incomplete one.

A high ROAS looks impressive in a monthly report, making it an easy metric for large, overpriced agencies to point to as a sign of "success." But it completely ignores your actual business costs. As an experienced, individual consultant, I know that a great campaign isn't just about generating revenue; it's about generating profitable revenue.

Why Your Agency Loves ROAS

Let's be honest: focusing solely on ROAS often benefits the agency more than it benefits you. Here’s why it’s their favorite metric:

It Justifies Fees: A 500% ROAS sounds fantastic on a call and makes it easy for a bloated agency to justify its management retainer, even if your profit margins are razor-thin.

It's Easy to Manipulate: Pushing high-volume, low-margin products can easily inflate ROAS figures without adding a single dollar to your bottom line.

It Avoids Difficult Conversations: Talking about your Cost of Goods Sold (COGS), shipping fees, and operational overhead is complex. ROAS keeps the conversation simple, but dangerously superficial.

An individual consultant’s value is tied directly to your profitability. We succeed when you succeed. A bloated agency can succeed just by hitting a ROAS target, even if your business is struggling.

The Consultant's Focus on Real Profit

Conversely, an independent specialist like me drills down on ROI to ensure every dollar—from ad spend to management costs—delivers a tangible return. This approach demands a much deeper understanding of your business financials, moving way beyond the surface-level data you see in Google Ads.

It’s about building a sustainable growth engine, not just a flashy campaign.

Here’s a simple table to break down what each metric actually reveals about your business performance.

ROI vs ROAS Core Differences

This table offers a direct comparison of Return on Investment (ROI) and Return on Ad Spend (ROAS), highlighting what each metric truly reveals about your business's health.

Aspect | ROAS (Return on Ad Spend) | ROI (Return on Investment) |

|---|---|---|

What It Measures | Gross revenue generated per dollar of ad spend. | Net profit generated from the total investment. |

Scope | Narrow: Focuses only on advertising costs. | Broad: Includes ad spend, COGS, fees, and overhead. |

Primary Question | "How effective are my ads at generating revenue?" | "Is this marketing initiative actually making money?" |

Typical User | In-platform campaign managers, often at large, impersonal agencies. | Business owners and dedicated, specialized consultants. |

Ultimately, ROAS is a tactical metric for front-line campaign management, while ROI is the strategic metric that tells you if your business is actually winning.

What ROAS Reveals—And What It Conceals

Return on Ad Spend (ROAS) is often the most visible metric you'll see inside platforms like Google Ads. It’s built to answer one simple, immediate question: for every dollar I spend on ads, how much revenue did I get back?

This makes it a pretty powerful tactical tool.

The calculation itself is straightforward:

ROAS = Revenue from Ads / Cost of Ads

So, if you spend $1,000 on a campaign and it generates $4,000 in sales, your ROAS is 4:1 (or 400%). That number tells a campaign manager that something is working—maybe the ad copy is hitting the mark or the keyword targeting is spot-on. It’s a great signal for making quick, in-platform tweaks to things like bidding strategies.

The Allure of Simplicity

A high ROAS is seductive. It’s a clean, easy-to-digest number that looks fantastic in a monthly report. This is precisely why so many overpriced, bloated agencies love to make it their headline metric. It lets them claim "value" without ever having to get into the weeds of your actual business health.

For them, a high ROAS justifies their hefty retainer, even if that ROAS is built on the back of low-margin products that don't really move the needle for your bottom line. It’s a performance metric that conveniently ignores the messy, complex reality of actually running a business.

Relying solely on ROAS is like celebrating a full house without knowing what it cost to buy into the game. A real consultant makes sure you know the price of your chips before you place your bets—a level of strategy that mass-market agencies just don't provide.

What ROAS Dangerously Hides

The simplicity of ROAS is also its biggest weakness. While it shows top-line revenue efficiency, it completely hides the most critical parts of your profitability. As an independent consultant whose success is directly tied to your business growth, I know that what ROAS hides is far more important than what it shows.

Here's a quick rundown of what ROAS completely ignores:

Profit Margins: A 400% ROAS on a product with a 10% profit margin is a disaster. But a 300% ROAS on a product with a 70% margin could be wildly profitable.

Cost of Goods Sold (COGS): The metric doesn’t care if your product cost $5 or $500 to make.

Operational Overhead: All those other costs—shipping, packaging, transaction fees, software subscriptions—are totally invisible to ROAS.

Management Fees: The cost of the agency or consultant running your ads isn't factored into the standard ROAS calculation, masking your total investment.

This limited view is why a specialist like me focuses on your unique business model first. We have to understand your break-even point before a single dollar is ever spent. It's the fundamental difference between just managing an ad account and acting as a true growth partner. Choosing the right ad format is also part of this strategic foundation; our guide on search ads vs. display ads offers deeper insights into making these cost-effective decisions from the get-go.

Ultimately, ROAS is a useful directional tool for campaign tactics but a very poor measure of overall business success.

Why ROI Is Your True North for Profitability

While ROAS is a decent snapshot of campaign performance, Return on Investment (ROI) tells the whole story of your business's health. It answers the one question that really matters: "Is our marketing actually making the company money?"

A bloated agency might flash a high ROAS because it’s an easy metric to pump up and looks great on a report. But my focus as a dedicated consultant is always on your bottom line. We aren't just chasing revenue numbers; we're building sustainable, long-term profit that fuels real growth.

This requires a different mindset and a more honest formula:

ROI = (Net Profit / Total Investment) x 100

This calculation immediately shifts the conversation away from surface-level ad metrics and toward what truly drives your business forward.

Defining Your Total Investment

This is where a specialist’s approach really diverges from a typical agency. "Total Investment" isn't just your ad spend. It's every single cost that chips away at your profit margin. Getting this right is non-negotiable if you want to understand your real performance.

Your true total investment has to include:

Ad Spend: The direct cost you pay to Google, Meta, or any other ad platform.

Management Fees: The cost for my specialized expertise and hands-on campaign management.

Cost of Goods Sold (COGS): What it actually costs you to produce the product or deliver the service you sold.

Overhead Costs: All the other expenses, like software subscriptions, shipping, and payment processing fees.

Only when you account for all of these costs can you calculate a genuine ROI. This is a level of strategic depth you just won't get from a mass-market agency that relies on standardized, one-size-fits-all reporting.

An expert consultant builds strategies to maximize your net profit, not just your ad revenue. This means even a modest-looking ROAS can be driving incredible, sustainable business growth—a critical insight that gets completely lost when you only focus on superficial metrics.

The Clear Distinction in Practice

The difference between ROI and ROAS isn't just academic; it has massive, real-world consequences for your budget and strategy. ROAS measures top-line ad efficiency, while ROI measures bottom-line business success.

It’s simple: ROAS only looks at revenue generated per dollar of ad spend. ROI forces you to account for all related costs to find your actual net profitability. This is exactly why so many businesses overestimate their campaign success—they’re looking at a great ROAS without seeing the full cost picture.

This is why my partnerships are so effective. I start by getting a clear handle on your entire financial picture. From there, the search engine marketing strategies we build are designed from day one to boost your actual ROI, not just an easily manipulated ROAS figure.

Why This Holistic View Is Your Advantage

Working with an expert consultant who puts ROI first gives you a huge edge. While your competitors are busy chasing a higher ROAS—guided by agencies that don't know their margins—you’ll be making smarter, data-driven decisions based on real profitability.

This focus allows us to:

Set Realistic Goals: We'll know your exact break-even point and can set performance targets that guarantee every conversion is profitable.

Optimize for Profit, Not Just Clicks: Every decision, from keyword bidding to ad copy, is aimed at attracting customers who actually contribute to your bottom line.

Provide True Transparency: You'll always know exactly how much net profit your marketing is generating. No vanity metrics, no hiding behind confusing reports.

This is the kind of strategic alignment you simply can't get from an agency juggling hundreds of clients with a cookie-cutter approach. I make your business's unique financial health the foundation of our entire PPC strategy.

How a Good ROAS Can Mask a Bad Investment

This is the classic trap where so many agency-led campaigns go wrong. A high ROAS creates a powerful illusion of success, tricking you into pouring more money into a campaign that’s actually hemorrhaging cash. It’s a scenario I see constantly when taking over accounts from overpriced, bloated agencies that use a flashy ROAS to justify their retainers while completely ignoring your real financial health.

Let's walk through this exact situation with a realistic e-commerce example. This step-by-step financial breakdown shows how a great-looking ROAS can quickly become a significant net loss.

The Agency's "Successful" Campaign

Picture this: you're selling a premium skincare product online. A big, impersonal agency is running your Google Ads, and they're thrilled to report a 400% ROAS (4:1) for the month. On the surface, it looks like a clear win.

Here’s the top-level data they show you in their slick report:

Total Ad Spend: $10,000

Total Revenue Generated: $40,000

ROAS: $40,000 / $10,000 = 400%

Based on this one metric, the agency tells you to increase your budget. They hit their target, and their report card looks great. But as a consultant, my first question isn't about their ROAS—it's about your profit. This is where a generic service provider stops and a true partner begins.

The Real Cost of Doing Business

Now, let’s peel back the layers and look past the agency’s vanity metrics. We need to factor in all the actual costs that went into generating that $40,000 in revenue. Any specialist worth their salt knows these numbers are non-negotiable for understanding true performance.

Cost of Goods Sold (COGS): Your products have a 50% margin, so your COGS is $20,000.

Platform & Shipping Fees: These costs (payment processing, packaging, shipping) eat up about 15% of revenue, totaling $6,000.

Agency Retainer: The bloated agency charges you a flat $5,000 per month for their "management."

Suddenly, the picture looks completely different. The numbers that actually matter to your business aren't the ones in the agency's report.

Calculating Your True ROI

To find your real profit, we have to calculate your ROI, not just the ROAS. This means we need to define your Total Investment, which is much more than just what you spent on ads.

Total Investment = Ad Spend + COGS + Fees + Agency Retainer Total Investment = $10,000 + $20,000 + $6,000 + $5,000 = $41,000

Now we can get to the bottom line—your Net Profit:

Net Profit = Total Revenue - Total Investment Net Profit = $40,000 - $41,000 = -$1,000

And finally, we can determine your true ROI:

ROI = (Net Profit / Total Investment) x 100 ROI = (-$1,000 / $41,000) x 100 = -2.44%

Despite a "good" 400% ROAS, your campaign actually lost over $1,000, resulting in a negative ROI. This is the critical blind spot that generic agencies exploit—they celebrate the revenue while ignoring your losses.

This exact situation—a negative ROI hiding behind a positive ROAS—is one of the biggest risks advertisers face. Your ROAS might signal an efficient ad spend, but if the total investment is more than the revenue, your ROI can completely tank. An ROI of -16.67%, for instance, means you lost nearly 17 cents for every dollar you put in, even if the ROAS looked solid. This is why you must assess both metrics. You can read more about how to avoid poor investment decisions on Apexure.com.

This analysis is exactly why my first step as a consultant is to dig into your unique business margins. We calculate your break-even ROAS—the absolute minimum you must hit just to avoid losing money. This foundational work is what separates a dedicated partner from a high-volume service provider.

Choosing The Right Metric For Your Business Goal

The ROI vs. ROAS debate completely misses the point. This isn't about one metric being "better" than the other. It's about knowing which tool to pull out of the toolbox for the job at hand. A true strategist knows when to chase ROAS for quick wins and when to anchor the entire strategy in ROI for long-term, sustainable growth.

This is a level of nuanced thinking that gets lost inside big, bloated agencies. As a dedicated consultant, my success is tied directly to yours. We don't just run ads; we match your campaign goals to your business reality.

Startups vs. Mature Businesses: A Tale Of Two Metrics

Think about a startup launching a game-changing new product. Their immediate goal isn't profit. It's about grabbing market share and getting their name out there. In that scenario, we’d want to maximize reach with a high ROAS. We might even accept a temporarily low or negative ROI just to dominate the space and collect that first wave of customer data.

Now, consider a mature business with established market share and much tighter margins. They face a completely different problem. For them, a high ROAS is just a vanity metric if it doesn't translate directly into profit. Maximizing ROI is the only game that matters, and every single decision has to be weighed against its real impact on the bottom line.

A cookie-cutter agency will slap the same ROAS-focused template on both the startup and the mature business—and fail them both. An experienced consultant diagnoses your business's unique situation first, then prescribes the right metric-driven strategy.

Low-Margin E-commerce vs. High-Value Lead Gen

The right metric also changes dramatically based on your business model. An e-commerce store with a slim 20% profit margin needs an incredibly high ROAS just to break even once you factor in all the other costs. Chasing a 300% ROAS could easily still result in a net loss.

On the other hand, a B2B company generating leads for a $50,000 service can play a completely different game. A lower ROAS is perfectly fine if it brings in just one highly profitable client. The focus here isn’t on the immediate ad return but on the lifetime value of that conversion. This is where understanding your cost per acquisition is fundamental to success.

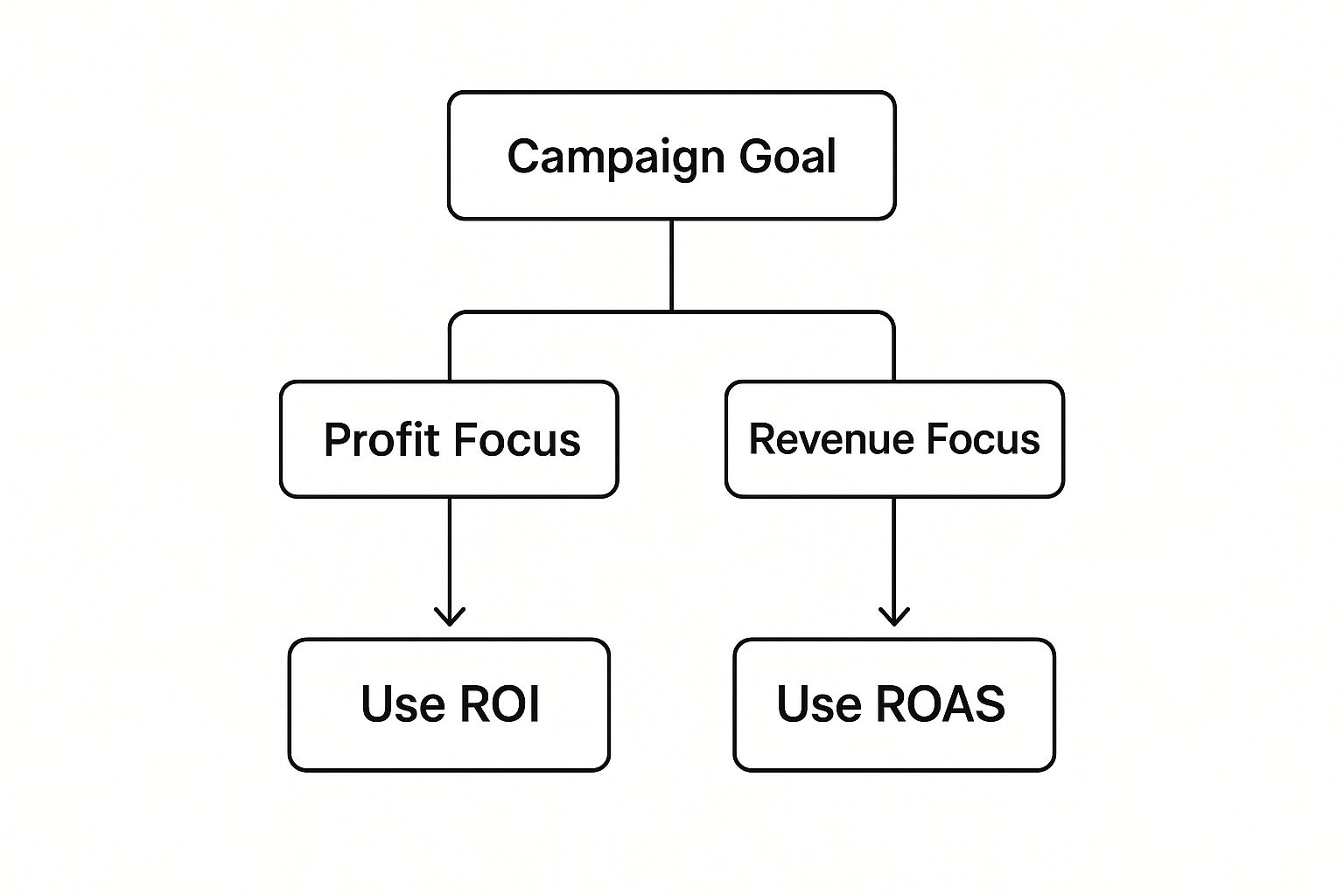

The infographic below helps simplify how to align your main metric with your campaign’s actual purpose.

As you can see, the decision really boils down to whether you're focused on immediate revenue generation or overall business profitability.

To make this even clearer, here’s a quick decision-making table to help you determine where your focus should lie.

When to Focus on ROI vs ROAS

Your Business Objective | Primary Metric Focus | Strategic Rationale |

|---|---|---|

Rapid Growth & Market Share | ROAS | Your goal is top-line revenue and visibility. You need to know if your ads are efficiently generating sales, even if overall profitability is a secondary concern for now. |

Profit Maximization | ROI | Your margins are tight, and every dollar must contribute to the bottom line. You need the full picture, including all associated business costs, to ensure growth is sustainable. |

New Product Launch | ROAS | The immediate goal is to validate demand and acquire initial customers. A high ROAS shows the ad creative and targeting are working, providing crucial early data. |

Scaling a Proven Offer | ROI | You already have product-market fit. Now, you need to scale profitably. ROI ensures that as you increase ad spend, your business actually makes more money. |

Lead Generation (High LTV) | ROI | The value of a lead isn't the initial transaction but the long-term contract. ROAS is misleading here; you need to track profitability over the entire customer lifecycle. |

Seasonal/Flash Sales | ROAS | These are short-term campaigns designed to generate a huge volume of sales quickly. The focus is on maximizing immediate ad-driven revenue. |

This framework isn't about picking a metric and sticking with it forever. It's about adapting your focus as your business objectives change, ensuring your ad strategy is always working for you, not against you.

Got Questions About ROI vs. ROAS? You're Not Alone.

When you're trying to figure out what's actually working in your ad accounts, the ROI vs. ROAS debate can get confusing. A lot of agencies toss these terms around, but few dig into what they really mean for your bottom line.

Let's clear things up with some straight answers to the questions I hear most often from clients.

Here, we'll get practical. We'll talk about what "good" actually looks like and how to use these metrics without getting misled.

What Is a Good ROI for Marketing?

There's no magic number here. A "good" ROI is completely dependent on your specific business—your profit margins, your overhead, and what you need to actually grow.

That said, a common benchmark many businesses shoot for is a 5:1 ratio. This means you're generating $5 in net profit for every $1 you invest.

But don't treat that as a hard rule. A high-margin SaaS company might be thrilled with a 3:1 ROI. A low-margin eCommerce store selling physical goods might need a 10:1 just to stay afloat. This is where an expert consultant adds real value—we define a target ROI based on your numbers, not some generic industry average fed to you by an agency.

Can I Calculate ROI Directly in Google Ads?

No. And this is a massive blind spot that catches way too many businesses—and even some agencies—off guard.

Google Ads is great at tracking ROAS. It knows exactly how much you spent on ads and how much revenue those ads brought in. What it doesn't know is anything about your actual business costs.

The Google Ads platform has zero visibility into your cost of goods sold, shipping fees, software subscriptions, overhead, or even the fee you pay a consultant like me. True ROI has to be calculated manually by putting your ad data and your business financials together.

Should I Ignore ROAS and Only Track ROI?

Absolutely not. Framing this as an "either/or" decision is a classic mistake. The smart approach is to see them as two different tools for two different jobs. One is for strategy, the other is for tactics.

ROI is your strategic North Star. It tells you if your marketing is actually making the business money. It’s the big-picture metric that a business owner and I review monthly or quarterly to confirm the entire operation is profitable.

ROAS is your tactical, in-the-trenches metric. We use it for real-time campaign optimization. A hands-on manager looks at ROAS daily or weekly to see if a bidding change or new ad copy is making the campaigns more efficient at generating revenue.

These two metrics are most powerful when used together. A healthy ROAS confirms your campaigns are running efficiently. A strong ROI proves that efficiency is translating into actual, take-home profit. This dual focus is how a specialist ensures your ads aren't just busy, but profitable.

Stop settling for vanity metrics that look good in a report but drain your bank account. Work with an expert who is as focused on your bottom line as you are.

At Come Together Media LLC, I provide the one-on-one strategic guidance you need to move past a misleading ROAS and build campaigns around what truly matters: your profitability.

Book a free, no-commitment consultation today, and let's build a campaign that drives real growth.