How to Calculate Return On Ad Spend: An Expert Consultant's Guide

- Chase McGowan

- Sep 2, 2025

- 11 min read

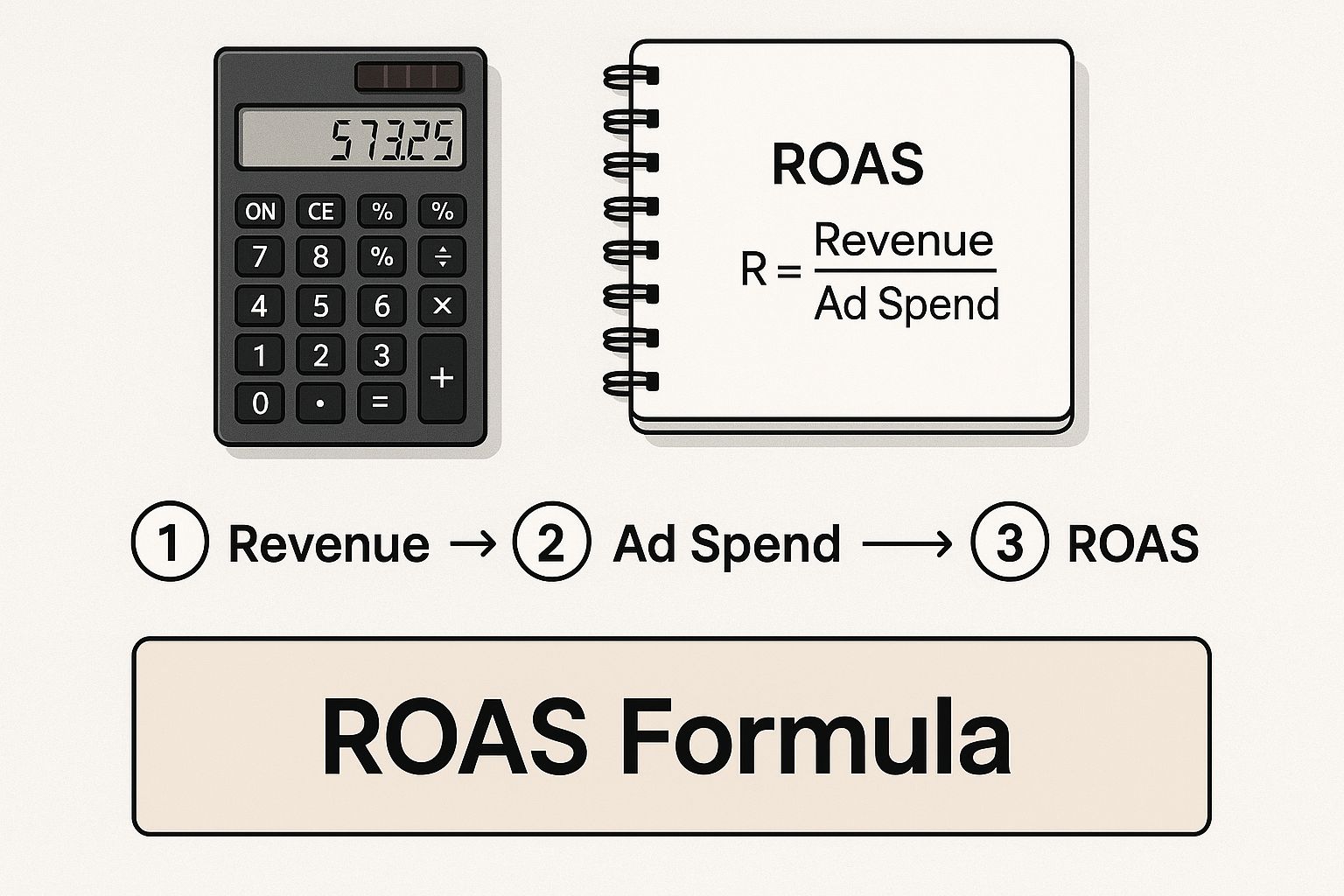

To get your Return On Ad Spend (ROAS), the basic math is simple: you divide the total revenue from your ads by your total ad costs. That formula—Revenue ÷ Ad Cost—is your starting point for figuring out if your advertising is actually making you money.

But it’s just the start. And it's where over-priced, bloated agencies love to stop, leaving your actual profits in the dark.

Why Your Agency's ROAS Is a Vanity Metric

Before we get into the weeds, let's talk about a costly mistake I see all the time: businesses blindly trusting the generic ROAS report their agency hands them. It’s a classic story. A big, impersonal agency shows you a rosy 4:1 or 5:1 ROAS that looks incredible on paper but has zero connection to your actual profit.

How does this happen? Bloated agencies often calculate ROAS using only the direct ad platform spend. They conveniently leave out all the other real-world costs that chip away at your margins. As an independent, specialist consultant, my focus is different. My success is tied directly to your bottom line, not just a report that looks impressive to a junior account manager.

The Hidden Costs Big Agencies Ignore

Large agencies love simplified metrics because it makes their performance look better than it is. But a true ROAS calculation—the kind a dedicated expert provides—has to be honest about every single dollar you spend.

Here’s what usually gets left on the cutting room floor:

Hefty Management Fees: Their own significant monthly retainer is almost never factored into the "ad cost." This is the oldest trick in the agency playbook.

Creative Production: The money spent designing graphics, shooting videos, or writing ad copy is often brushed aside as a separate, unrelated expense.

Essential Software Subscriptions: Costs for tracking tools, analytics platforms, or reporting dashboards? Frequently omitted from their self-serving calculations.

This kind of selective accounting paints a dangerously misleading picture. This guide is about teaching you to see through that agency smoke and mirrors. We're going to walk through how to calculate a ROAS that actually measures financial success—the same way I do for every one of my clients.

As digital ad spending skyrocketed from $243.1 billion to an estimated $740.3 billion between 2017 and 2024, the need for accurate measurement has become non-negotiable. You can find more insights on digital ad spend trends on Oberlo.com.

My goal here is to shift your perspective from just chasing clicks to generating real, sustainable profit—the kind of detailed, profit-focused work a dedicated expert delivers, not a faceless agency.

The Real Formula to Calculate Return On Ad Spend

Let's cut through the noise. Most agencies use a deceptively simple formula for ROAS, and frankly, it’s misleading. Calculating your true Return On Ad Spend is a lot more involved than just dividing revenue by what you paid Google.

An honest calculation—the kind you get from an individual consultant who's actually invested in your profitability—requires looking at your total investment. This is the only way to know if your campaigns are actually making you money.

Think about it. An agency might brag about a great ROAS based on the $1,000 you spent on Google Ads. But what about their $1,500 monthly management fee? Or the $200 you shelled out for tracking software? All of a sudden, your real ad cost isn’t $1,000; it’s $2,700. Your ROAS just plummeted.

That’s the difference between a vanity metric an agency uses to keep you happy and a real business KPI I use to make you money.

The image below breaks down what should really be included in your ROAS calculation.

As you can see, your actual cost is much bigger than what shows up on a single invoice from your ad platform.

Defining Your True Advertising Costs

To get an accurate ROAS, you have to account for every single dollar related to your advertising. This is a non-negotiable step that, unfortunately, many large, impersonal agencies conveniently skip because it makes their numbers look worse.

So what does that include? Here’s a quick rundown:

Direct Ad Spend: This is the obvious one—the money paid directly to platforms like Google or Meta.

Management Fees: The cost of hiring an agency or a consultant. Yes, this counts! I always include my fee in ROAS calculations for full transparency.

Software & Tools: Subscriptions for landing page builders, analytics platforms, or call tracking software add up.

Creative Production: Don't forget the costs for video creation, graphic design, or copywriting for the ads themselves.

But it’s not just about listing them out; it’s about understanding the hidden costs that can quietly eat into your profits.

Components of a True Ad Cost Calculation

Cost Category | Example | Why It's Often Missed |

|---|---|---|

Agency/Consultant Fees | $1,500 retainer for PPC management. | Many agencies conveniently exclude their own fees from the "Ad Cost" part of the equation to inflate their ROAS figures. I consider this practice dishonest. |

Third-Party Software | $200/mo for a call-tracking tool. | These are often billed separately from the ad platforms, so they don't get bundled into the campaign-level cost analysis. A lazy approach ignores them. |

Creative Development | $500 for a new set of ad creatives. | This is often seen as a one-off "marketing expense" rather than being tied directly to the performance of the campaigns it supports. |

Affiliate Commissions | 10% commission on sales from an affiliate. | If you're paying partners to drive traffic to your paid ads, their cut is absolutely part of your total ad cost. |

Tallying up these costs is the only way to get a real, honest look at your advertising investment.

It's the critical difference between a campaign that looks good on an agency dashboard and one that actually adds to your bottom line.

Of course, the other side of the equation is revenue, which needs just as much scrutiny, especially for businesses with long or complex sales cycles. For a much deeper dive into this, check out this consultant's guide to calculating real ROAS profit. Following this framework ensures the number you see reflects the true financial health of your advertising.

Setting Up Tracking for an Accurate ROAS

Your return on ad spend is only as good as the data you feed it. This is where so many big agencies drop the ball. They’ll set up some basic tracking, flip the switch on your campaigns, and send you the bill. But from my experience as a specialist, flawless, meticulous tracking isn't just a nice-to-have—it's the absolute foundation for understanding what’s really happening. It’s a step a true expert never rushes.

This isn’t about just dropping a snippet of code on your site. It’s about building a rock-solid data infrastructure that captures every single action a user takes that brings value to your business. Anything less, and your ROAS is just a shot in the dark. An agency managing 50 accounts doesn't have time for this level of detail; I make the time.

Beyond Basic Conversion Tracking

A bloated agency might see a form submission and call it a day. That’s not nearly enough. To get the full picture, we need robust conversion tracking configured across both Google Ads and Google Analytics. This means capturing every valuable touchpoint with precision.

What does this actually look like in my practice?

E-commerce Sales: We're not just tracking the sale. We're tracking the specific transaction value and, where possible, even the product-level profit margins.

Lead Form Submissions: Instead of treating all leads as equal, we assign a monetary value—either static or dynamic—based on how qualified that lead is.

Phone Calls: We use dynamic number insertion to see which calls came directly from your ads, separating them from your organic traffic.

Getting this granular is the only way to find out what’s truly driving profit. It's how you discover that one campaign is sending you tons of low-value leads, while another is bringing in fewer, but far more profitable, phone calls. This is the difference individual specialization makes.

A huge mistake I see all the time is treating tracking as a "set it and forget it" task. If you assign the wrong value to a conversion or miss a cross-domain tracking issue, your data gets completely distorted. Suddenly, a campaign that's making you money can look like a total failure.

Avoiding Common Tracking Gaps

Agencies juggling dozens of clients often rely on a one-size-fits-all template for tracking. This approach almost always misses critical details. For example, what happens if a customer starts on your website but completes their purchase on a third-party booking platform? Standard tracking breaks, and that revenue disappears from your reports. This is a classic cross-domain tracking problem that makes your data worthless.

Fixing these gaps is detailed, painstaking work—the kind of work a dedicated consultant prioritizes from day one. I make sure every dollar is accounted for by spotting and fixing these common issues before they can throw off your numbers. You can get a sense of just how deep this process goes by learning more about how to fix your Google Ads conversion tracking.

This level of precision is what separates vanity metrics from real, actionable business intelligence.

So, What’s a “Good” ROAS, Anyway?

You’ve probably heard the 4:1 ROAS number tossed around. Agencies love it. It sounds solid, and it's an easy benchmark to point to. But honestly? It's mostly meaningless without context.

That number is a classic agency shortcut. It makes their performance look good on a slide deck, but it says absolutely nothing about whether your business is actually making money. A "good" ROAS isn't a universal standard; it’s a number that's completely unique to your business's financial health.

When I start working with a new client, we ignore the industry averages. Instead, as a profit-focused consultant, I dig into the only thing that really matters: your bottom line. It's time to move past arbitrary goals and figure out your actual break-even point.

Forget Benchmarks—Find Your Break-Even ROAS

To make ROAS a useful metric—one that actually helps you make smart decisions—you have to know your profit margins. Cold.

Think about it: a 4:1 ROAS is incredible for a software company with 80% margins. But for an e-commerce store with tight 25% margins? That same 4:1 is a one-way ticket to going out of business. This is the exact detail that gets glossed over in a typical, surface-level agency relationship.

To get to your real baseline, you need to know your numbers inside and out:

Cost of Goods Sold (COGS): What does it actually cost to produce or acquire what you sell? Every direct cost goes here.

Operating Expenses: Don't forget overhead. We're talking salaries, rent, software subscriptions—all the costs of keeping the lights on.

Profit Goals: What are you trying to achieve right now? Are you in an aggressive growth phase and willing to accept a lower ROAS to acquire market share? Or is maximizing profit on every single sale the top priority?

Only when you factor in these variables can you set a real, custom Target ROAS. This is the number that ensures you’re building a profitable business, not just chasing impressive-looking revenue stats for an agency report.

Global ad spend is on track to hit a staggering $1.1 trillion in 2024, yet so many businesses are still measuring their success with flawed metrics. With digital ads making up 72.7% of that spend, you can't afford to guess. You need a personalized ROAS target to stay competitive. You can dig into more global advertising trends at DataReportal.

The Overlooked Metric: Customer Lifetime Value

Here’s another blind spot for most agencies: Customer Lifetime Value (LTV). They're incentivized to show you quick wins, not long-term growth.

Let's say a campaign hits a 2:1 ROAS on the initial purchase. An agency focused on short-term metrics would probably panic and pause it. But what if that same customer comes back and makes three more purchases over the next year without any additional ad spend?

Suddenly, that "underperforming" campaign looks a lot different.

A true expert consultant looks at the entire picture. We evaluate how your ad spend is acquiring customers who become long-term assets, not just one-off sales. This is the kind of strategic perspective that gives you the clarity to make smart, profitable decisions for the long haul—something you won't get from a junior account manager at a bloated agency.

Practical Strategies to Drastically Improve Your ROAS

Once you have an honest ROAS number, the real work begins. Improving it is where specialized, hands-on expertise makes a world of difference compared to a set-it-and-forget-it agency approach. These are the high-impact strategies I implement for my clients every single day—the ones that turn stagnant campaigns into growth engines.

Forget generic advice. Real improvement comes from granular, profit-focused optimizations. For instance, instead of structuring campaigns around product categories, I often rebuild them based on profit margin. This simple shift ensures your budget automatically flows toward the products that make you the most money, not just the ones that generate the most revenue.

This is a fundamental change in strategy that a junior account manager at a large agency simply won't implement. They’re trained to chase revenue, not your actual profit.

Beyond the Basics of Optimization

Another area where a specialist shines is with sophisticated tools like Performance Max. A lazy, agency-style approach is to lump all your products into one campaign. I take the time to segment asset groups by performance, margin, or buyer intent. This gives you precise control over your budget and messaging.

Here are a few other tactics that drive real growth:

Building Hyper-Specific Negative Keyword Lists: We don't just add obvious negatives like "free." I analyze search query reports weekly to eliminate budget-wasting clicks from irrelevant searches, saving thousands of dollars over time.

Refining Audience Targeting: We move beyond broad demographics to build custom audiences based on past purchase behavior, website engagement, and even offline data to find your most valuable customers.

Optimizing the Entire Funnel: Improving ROAS isn’t just about the ad. As a consultant, I analyze the landing page experience, conversion rates, and checkout friction to ensure the traffic you’re paying for has the best possible chance to convert.

This hands-on approach is more critical than ever. With global ad spend forecasted to grow by 10.7% in 2024 to reach $1.08 trillion, the competition for attention will be fierce. Proactive, intelligent optimization is the only way to protect and grow your returns in such a crowded market. You can explore more insights on this unprecedented ad spend growth on WARC.com.

These detailed optimizations are what separate an average result from exceptional performance. It’s the difference between having an agency manage your ads and having an expert grow your business.

Answering Your Top ROAS Questions

If you're finding the world of ad metrics a bit confusing, you're not alone. I get these same questions all the time from clients, often because they've been given some fuzzy answers by a big, faceless agency. Let's clear things up with the directness you get from an individual expert.

What's the Real Difference Between ROAS and ROI?

This is the big one, and the distinction is crucial. An agency will talk ROAS; a business partner will talk ROI.

ROAS (Return On Ad Spend) is a surface-level marketing metric. It tells you the gross revenue you got back for every single dollar you put into ads. It's a simple, direct calculation: "Did my ads bring in more money than they cost?"

ROI (Return On Investment), on the other hand, is a true business metric. It measures your actual profit after you've paid for everything—the ad spend, my consultant fee, the cost of your products, you name it.

A campaign can look great with a high ROAS but still be losing you money if your profit margins are thin. Agencies love to flash a big ROAS number, but as an expert consultant, I'm focused on one thing: a healthy, positive ROI for your business. For a much deeper dive, I've broken down the critical differences in this consultant's guide to real profit between ROI vs. ROAS.

How Do I Figure Out ROAS for Lead Generation?

This is a smart question. For businesses that rely on leads instead of direct sales, you need to work backward and put a dollar value on each lead.

Here's how I do it with my clients: we multiply your lead-to-sale conversion rate by your average customer lifetime value (LTV).

Let's say 1 out of every 10 leads turns into a paying customer, and your average customer LTV is $2,000. That means each lead you generate is worth $200 to your business. We then plug that $200 value in as the "revenue" part of your ROAS formula. Simple as that.

Why Is My ROAS Different Across Google Ads and Analytics?

Seeing different numbers in Google Ads and Google Analytics usually boils down to one thing: attribution modeling.

Think of it like this: Google Ads often uses a data-driven model that gives credit to multiple ad clicks along a customer's journey. Google Analytics, however, might be set to a "Last Click" model, giving all the credit to the final ad they clicked.

They're just assigning the revenue differently. It’s absolutely essential to pick one platform and make it your "single source of truth." This is one of the first things a dedicated consultant will lock down to make sure your reporting is consistent and trustworthy, eliminating the confusion that big agencies often create.

Ready to stop guessing and start seeing profitable, predictable results from your Google Ads? As a hands-on, specialist consultant, I provide the one-on-one strategic guidance that bloated agencies just can't offer. Come Together Media LLC is here to deliver transparent, profit-focused results.